Pentax 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

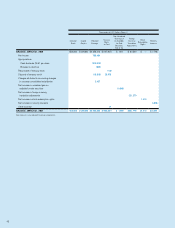

No. 3 INVESTMENT SECURITIES

Investment securities as of March 31, 2007 and 2006 consisted of the following:

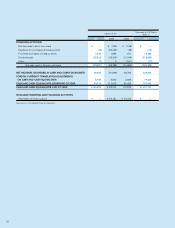

Millions of Yen Thousands of U.S. Dollars

2007 2006 2007

Marketable equity securities ¥1,542 ¥1,875 $13,062

Non-marketable equity securities 1,356 1,081 11,487

Total ¥2,898 ¥2,956 $24,549

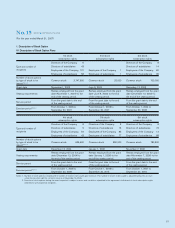

The carrying amounts and aggregate fair values of marketable equity securities at March 31, 2007 and 2006 were as follows:

Millions of Yen

Cost Unrealized Gains Unrealized

Losses Fair Value

March 31, 2007:

Available-for-sale—Equity securities ¥1,693 ¥— ¥151 ¥1,542

March 31, 2006:

Available-for-sale—Equity securities 1,693 182 — 1,875

Thousands of U.S. Dollars

Cost Unrealized Gains Unrealized

Losses Fair Value

March 31, 2007:

Available-for-sale—Equity securities $14,341 $— $1,279 $13,062

Available-for-sale securities whose fair value was not readily determinable as of March 31, 2007 and 2006 were as follows:

Carrying Amount

Millions of Yen Thousands of U.S. Dollars

2007 2006 2007

Equity securities ¥1,100 ¥ 802 $ 9,318

Investment to limited partnership and others 256 279 2,169

Total ¥1,356 ¥1,081 $11,487

There were no sales of available-for-sale securities for the years ended March 31, 2007 and 2006.

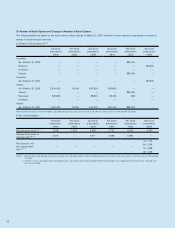

u. Stock Option—Effective April 1, 2006, the Company and its

consolidated subsidiaries adopted the new accounting standard,

“Accounting Standard for Share-based Payment” (Statement

No.8 issued by the Accounting Standards Board of Japan on

December 27, 2005) and the implementation guidance, “Guidance

on Accounting Standard for Share-based Payment” (Guidance

No.11 issued by the Accounting Standards Board of Japan on

December 27, 2005). As a result, operating income and income

before income taxes and minority interests for the current fiscal

year decreased by ¥167 million, respectively.

v. Reclassification and Restatement—Certain prior year amounts

have been reclassified to conform to the current year presentation.

Also, as described in Notes 2.q and 2.r, the consolidated balance

sheet for 2006 has been adapted to conform to new presentation

rules of 2007. Also, in lieu of the consolidated statement of share-

holders’ equity for the year ended March 31, 2006, which was pre-

pared on a voluntary basis for inclusion in the 2006 consolidated

financial statements, the Company prepared the consolidated state-

ment of changes in net assets for 2006 as well as for 2007.

These reclassifications had no impact on previously reported

results of operations or retained earnings.