Pentax 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

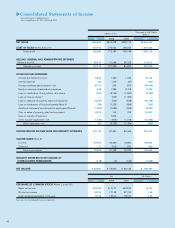

Net sales in the Electro-Optics division rose 15.1% year on year to

¥219,252 million. In mask blanks for semiconductor production, where

Hoya holds a large share of the global market, a rising proportion of

sales came from such high-precision products as phase shift mask

blanks, as semiconductor feature sizes are required further to shrink.

In photomasks for semiconductor production, an area in which Hoya

has focused on cutting-edge development, there was also a rise in

sales of high-precision products. In photomasks for large-sized LCD

panels, however, sales were down as a result of falling unit prices

arising from greater competition in the photomask market. In glass

disks for hard disk drives (HDDs), Hoya enhanced its production

capacity in response to robust demand in the global market arising

from such factors as the replacement of desktop computers with

notebooks, achieving a sharp rise in revenue. In optical glass products,

demand for aspheric molded lenses expanded as a result of higher

resolutions and enhanced zoom features in digital cameras. Demand

for camera lenses for mobile phones was also strong, and sales rose.

Operating income in the Electro-Optics division rose 7.0% to

¥80,085 million. During the first half, high plant capacity utilization

rates underpinned by robust market demand kept the operating

income ratio around 38%, but the ratio declined in the second half due

to greater competition in the market for photomasks for large-sized

LCD panels, rising production costs for HDD glass disks arising from

the shift to a new technology (perpendicular magnetic recording), and

an increase in depreciation cost. By quarter, the operating income ratio

was 38.6% in the first quarter, 38.1% in the second quarter, 36.6% in

the third quarter and 32.6% in the fourth quarter.

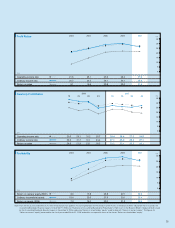

As indicated in the graph for “Sales Growth and Profitability of

Main Business Segments” (“the segment graph”), the net sales

growth rate in the Electro-Optics division, like in the previous year, was

higher than the consolidated average growth rate for net sales of

13.3% (the center of the circle is above the Consolidated Basis line),

while the operating income ratio declined slightly from the previous

fiscal year (the circle shifted to the left).

Capital expenditures in the Electro-Optics division rose 7.1% to

¥39,899 million, mainly for increases in production capacity for HDD

glass disks and optical lenses, and the establishment of a new plant

for large-sized LCD mask blanks.

Net sales for the Photonics division fell 9.9% from the previous

fiscal year to ¥9,093 million, while operating income fell 47.5% to

¥490 million. The main reason for the decline was a significant falloff in

sales of pattern defect correction equipment for LCDs.

36

Segment Overview

(%)

40

20

0

(Millions of yen)

250

,

000

200

,

000

150

,

000

100

,

000

50

,

000

0

2005 2006

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

165

,

664

63

,

290

38

.

1

162

,

638

14

,

730

31

,

962

190

,

552

74

,

862

39

.

1

204

,

192

18

,

716

37

,

244

219,252

80,085

36.5

258,746

27,449

39,899

120

,

000

100

,

000

80

,

000

60

,

000

40

,

000

20

,

000

0

2005 2006

94

,

971

17

,

079

18

.

0

90

,

765

5

,

900

6

,

787

104

,

457

20

,

370

19

.

5

98

,

243

6

,

444

7

,

958

119,808

21,167

17.7

118,229

7,405

11,672

Sales Growth and Profitability of Main Business Segments

Fiscal year ended March 31, 2007 (Compared with the previous fiscal year)

Sales Growth Ratio (%)

17

15

13

11

9

15

20

25

30

35

40

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 65, Segment Information.

Electro-Optics Division

Operating Income Ratio (%)

Consolidated Basis

Consolidated Basis

2007

2007

40

20

0

Health Care

Vision Care

Electro-Optics

Size of circle shows the volume of operating income.

0

5

10

15

20

25

30

35

40

130

100

70

40

10

-

20

Information Technology (Electro-Optics and Photonics Division)