Pentax 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Business Field

Hoya’s Crystal division met with lower sales. We are in the

process of reducing the size of this division to the most

appropriate scale. Hoya manufactures and sells tableware

including wine glasses and bowls, interior products such as

vases and clocks, and crystal jewelry. Given the contraction

of the market for gifts and the increasing competition from

overseas products, however, the size of such business is

decreasing year by year.

As CEO, I am always looking for the most appropriate

ways to allocate the finite amount of management resources

we have available. The authority to manage Hoya’s day-to-

day business has been delegated to a great extent to each

internal company, and I do not micro-manage execution.

As expressed by the well-known phrase, “selection and

concentration,” I believe that my role, given Hoya’s diverse

business strategy, is to send people and financial resources to

the areas identified as having the potential for future growth.

By the same token, this sometimes means I must address the

need to scale back in fields that show little prospect for

growth.

Future Prospects

In fiscal 2004 and 2005, we made large-scale investments in

plant and equipment to position our Information Technology

field for continued expansion in market demand. We plan to

achieve further growth in this business by effectively

managing those investments in fiscal 2006 and beyond.

Although some caution is in order due to the slipping sales

of digital cameras, the factors indicating further growth for

Hoya outnumber the concerns. These positive indicators

include the trend toward higher resolutions for camera-

equipped mobile telephones, the growing size of LCD

televisions, and expansion of the market for portable music

players. We will seize the opportunity presented by this

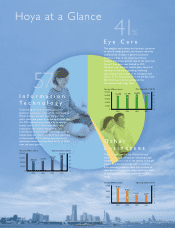

<Eye Care>

Net sales in our Vision Care division decreased 3.3% on the

previous year, and operating income was down 2.4%. Net

sales in the Health Care division grew 10.7%, and operating

income by 13.9%. Hoya is promoting a differentiation

strategy focusing on high-value-added products, to counter

the matured market for eyeglass and contact lenses.

Hoya is undertaking global development of its eyeglass

business. Given the differences in political and economic

systems and business practices in each country, and variations in

consumer preferences and lifestyles, we are working hard to

ensure that our business strategies are fine-tuned for all of these

local factors. In Japan, the price wars we have witnessed for the

past several years lost steam, and demand recovered for the

high-quality products in which Hoya excels, indicating the

potential for solid improvement in results. A decline in sales in

Europe was inevitable, given the elimination of the health

insurance system that had covered the purchase of new

eyeglasses in Germany, our largest market in the region, and the

temporary adjustments made necessary by the relocation of

laboratories in France and Spain.

In the contact lens business, we are operating a directly

managed specialty retail store chain, Eye City, and by the end

of March 2005 we had a total of 124 stores in Japan.

Throughout the fiscal year, we moved forward boldly with a

scrap-and-build program, and this has served to improve our

competitive position.

Hoya’s IOLs, used for the medical treatment of cataracts,

enjoy an excellent reputation for high quality in the market,

and this business continues to post strong sales growth.

Looking to the future, we expect that the number of older

people in developed nations who need cataract treatments

will increase. In anticipation of a global growth in demand,

Hoya took its first real step toward overseas deployment

during the fiscal year under review.

A MESSAGE TO OUR STAKEHOLDERS