Pentax 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

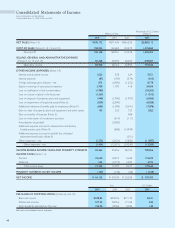

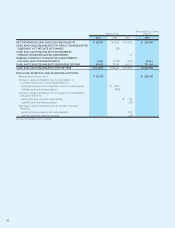

Consolidated Statements of Income

Hoya Corporation and Subsidiaries

Years Ended March 31, 2005, 2004 and 2003

Thousands of U.S. Dollars

Millions of Yen (Note 1)

2005 2004 2003 2005

NET SALES (Note 14) ¥308,172 ¥271,444 ¥246,293 $2,880,112

COST OF SALES (Notes 9, 12, 13 and 14) 158,024 142,683 133,275 1,476,860

Gross profit 150,148 128,761 113,018 1,403,252

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

(Notes 9, 12, 13 and 14) 65,228 60,594 60,035 609,607

Operating income 84,920 68,167 52,983 793,645

OTHER INCOME (EXPENSES) (Note 14):

Interest and dividend income 1,022 558 624 9,551

Interest expense (87) (189) (374) (813)

Foreign exchange gains (losses)—net 875 (2,900) (1,252) 8,178

Equity in earnings of associated companies 3,708 1,700 418 34,654

Loss on clarification of soil contamination (1,980) (18,505)

Loss on closure of plant in the fiscal year (1,264) (11,813)

Loss on disposal of property, plant and equipment (948) (1,900) (1,947) (8,860)

Loss on impairment of long-lived assets (Note 6) (859) (2,040) (8,028)

Additional retirement benefits paid to employees (Note 9) (843) (1,090) (3,691) (7,878)

Gain on sales of property, plant and equipment and other assets 195 523 725 1,822

Gain on transfer of business (Note 3) 488

Loss on write-down of investment securities (619) (111)

Amortization of goodwill (3,300)

Additional expense incurred to dissolve the contributory

funded pension plan (Note 9) (888) (14,949)

Additional expense incurred to abolish the unfunded

retirement benefit plan (Note 9) (351)

Other expenses—net (1,273) (2,526) (3,820) (11,897)

Other expenses—net (1,454) (12,671) (24,240) (13,589)

INCOME BEFORE INCOME TAXES AND MINORITY INTERESTS 83,466 55,496 28,743 780,056

INCOME TAXES (Note 11):

Current 18,690 18,574 5,648 174,673

Deferred 532 (2,775) 3,029 4,972

Total income taxes 19,222 15,799 8,677 179,645

MINORITY INTERESTS IN NET INCOME (109) (148) (28) (1,018)

NET INCOME ¥ 64,135 ¥ 39,549 ¥ 20,038 $ 599,393

Yen U.S. Dollars

2005 2004 2003 2005

PER SHARE OF COMMON STOCK (Notes 2.p and 17):

Basic net income ¥578.84 ¥350.96 ¥171.10 $5.41

Diluted net income 577.52 350.56 171.08 5.40

Cash dividends applicable to the year 150.00 100.00 50.00 1.40

See notes to consolidated financial statements.