Pentax 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

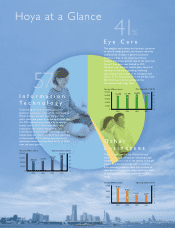

<Information Technology>

The Electro-Optics division saw net sales grow by 22.6%

over the previous year, and operating income was up 40.1%.

Both the growth in demand for digital consumer electronics

products and our ability to respond to market demand for

these products contributed to these good results.

Net sales in the Photonics division grew by 161.2%, and

the operating loss turned to operating income. The sales of

HOYA CANDEO OPTRONICS CORPORATION were

posted to the Electro-Optics division until the end of the

previous fiscal year but have now been classified in the

Photonics division beginning in the fiscal year under review,

which brought a significant increase over the previous year.

The Information Technology field was characterized by

growth in the first half of the fiscal year under review

followed by a slowdown in the second half. The optical lens

business was particularly symbolic of this trend. With Hoya’s

high market share in optical lenses used for digital cameras,

when production started to fall in the digital camera market

in the summer, the adverse effect was quite pronounced.

Hoya’s mask blank and photomask business closely

follows investment trends at our major customers—

semiconductor and LCD panel manufacturers—as they

develop new products. In this area too, activity focused in

the first half of the fiscal year under review, as some

manufacturers reduced their investment for R&D in the

second half. This produced a clearly discernible difference

between our first- and second-half results.

Demand for glass disks for HDDs, however, continued to

grow throughout the year. In addition to the strong demand

for small-sized disks for portable music players, growth was

supported by the steady demand for personal computers

and servers.

Digital consumer electronics are

a driver of good achievement.