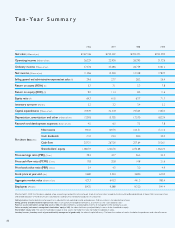

Pentax 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net sales of the Vision Care division declined 3.3% to ¥94,971 million. In

the domestic eyeglass lens market, the prolonged slump appears to

have hit bottom, and the trend toward moderate recovery continued,

with demand recovering for high-value-added products. Although sharp

price competition for low-priced products continued, Hoya increased

net sales by emphasizing sales of high-value-added products. In overseas

markets, on the other hand, net sales were sharply affected by a sluggish

market overall in Germany, the largest market for Hoya in Europe,

where sales fell in reaction to increased demand stimulated by reform

of the health insurance system in the previous consolidated fiscal year.

Under these circumstances, Hoya is pursuing a differentiation strategy

by selling high-value-added products such as high-index lenses and

highly functioned coatings in both the domestic and overseas markets.

Operating income for the Vision Care division decreased 2.4% to

¥17,079 million, while the operating margin was 18.0%, 0.2 percentage

point higher than in the previous consolidated fiscal year. Profitability

rose because of measures such as emphasis on high-value-added

products and a review of the production organization on a global basis.

Although the position of the circle for this division was lower on the

graph because net sales declined, affected mainly by the slump in the

European market, the circle shifted to the right somewhat because the

profit margin rose slightly. By quarter, the operating margin was 17.3% in

the first quarter, 17.4% in the second quarter, 20.1% in the third quarter

and 17.2% in the fourth quarter.

Capital investment in the Vision Care division decreased by 1.9% to

¥6,787 million. During the consolidated fiscal year under review, Hoya

continued to build a global production organization with a focus on

optimal production locations.

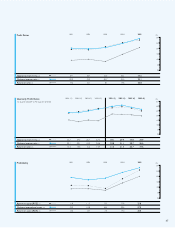

Eye Care (Vision Care Division)

(%)

40

20

0

(Millions of yen)

100,000

80,000

60,000

40,000

20,000

0

2003 2004 2005

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

94,388

15,398

16.0

98,077

5,578

3,935

98,203

17,496

17.8

92,082

5,735

6,916

94,971

17,079

18.0

90,765

5,900

6,787

(%)

40

20

0

(Millions of yen)

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

2003 2004 2005

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

26,717

5,089

19.0

16,447

571

426

28,381

6,273

22.1

18,873

532

1,201

31,409

7,141

22.7

18,330

669

738

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 64 Segment Information.

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 64 Segment Information.

Net sales for the Health Care division grew 10.7% to ¥31,409 million. In

contact lenses, within the context of continued price competition in the

market from discount retailers, Hoya sought to increase its

attractiveness to customers by aggressively pursuing scrap and build of

directly managed Eye City stores, and boosted net sales as a result of

offering customer services with a high level of professional expertise

and promoting multifocal lenses and other high-value-added products.

Net sales for IOLs also expanded strongly, as Hoya continued sales of

soft intraocular lenses and began selling yellow lenses and injectors, and

aggressively pursued business development not only in the domestic

market but also in overseas markets.

Operating income for the Health Care division increased 13.9% to

¥7,141 million. The full year operating margin improved by 0.6

percentage point to 22.7%. In addition to pursuing efficient

management, Hoya focused on further expansion of the business and

invested aggressively in product development and marketing.

On the graph, the position of the circle has shifted upward to the

right side. This shows that the division grew from the perspective of

both sales growth and profitability, although it lies slightly below the

consolidated average growth rate for net sales of 13.5%. By quarter, the

operating margin was 23.8% in the first quarter, 24.6% in the second

quarter, 21.9% in the third quarter and 20.6% in the fourth quarter.

Eye Care (Health Care Division)