Pentax 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

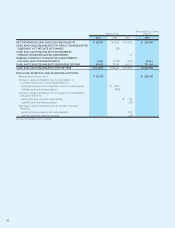

52

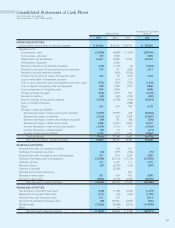

Thousands of U.S. Dollars

Millions of Yen (Note 1)

2005 2004 2003 2005

NET INCREASE IN CASH AND CASH EQUIVALENTS ¥ 28,784 ¥ 7,552 ¥ 10,259 $ 269,009

CASH AND CASH EQUIVALENTS OF NEWLY CONSOLIDATED

SUBSIDIARY AT THE DATE OF CHANGE 378

CASH AND CASH EQUIVALENTS INCREASED BY

MERGED UNCONSOLIDATED SUBSIDIARIES 41

FOREIGN CURRENCY TRANSLATION ADJUSTMENTS

ON CASH AND CASH EQUIVALENTS 3,666 (3,199) (927) 34,261

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 80,425 75,694 66,321 751,636

CASH AND CASH EQUIVALENTS, END OF YEAR ¥112,875 ¥ 80,425 ¥ 75,694 $1,054,906

NON-CASH INVESTING AND FINANCING ACTIVITIES:

Retirement of treasury stock ¥ 30,702 $ 286,935

Increase in assets and liabilities due to consolidation of

a subsidiary previously unconsolidated (Note 3):

Assets (primarily accounts receivable, inventory and property) ¥ 2,607

Liabilities (primarily trade payables) (870)

Increase in assets and liabilities due to merger of unconsolidated

subsidiaries (Note 3):

Assets (primarily inventory and property) ¥ 82

Liabilities (primarily trade payables) (37)

Decrease in assets and liabilities due to transfer of business

(Note 3):

Assets (primarily property and rental deposits) 434

Liabilities (primarily deposit received) (28)

See notes to consolidated financial statements.