Pentax 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

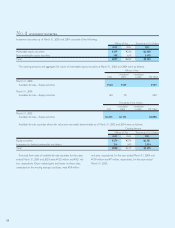

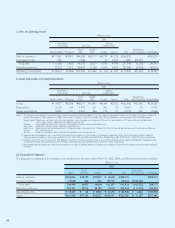

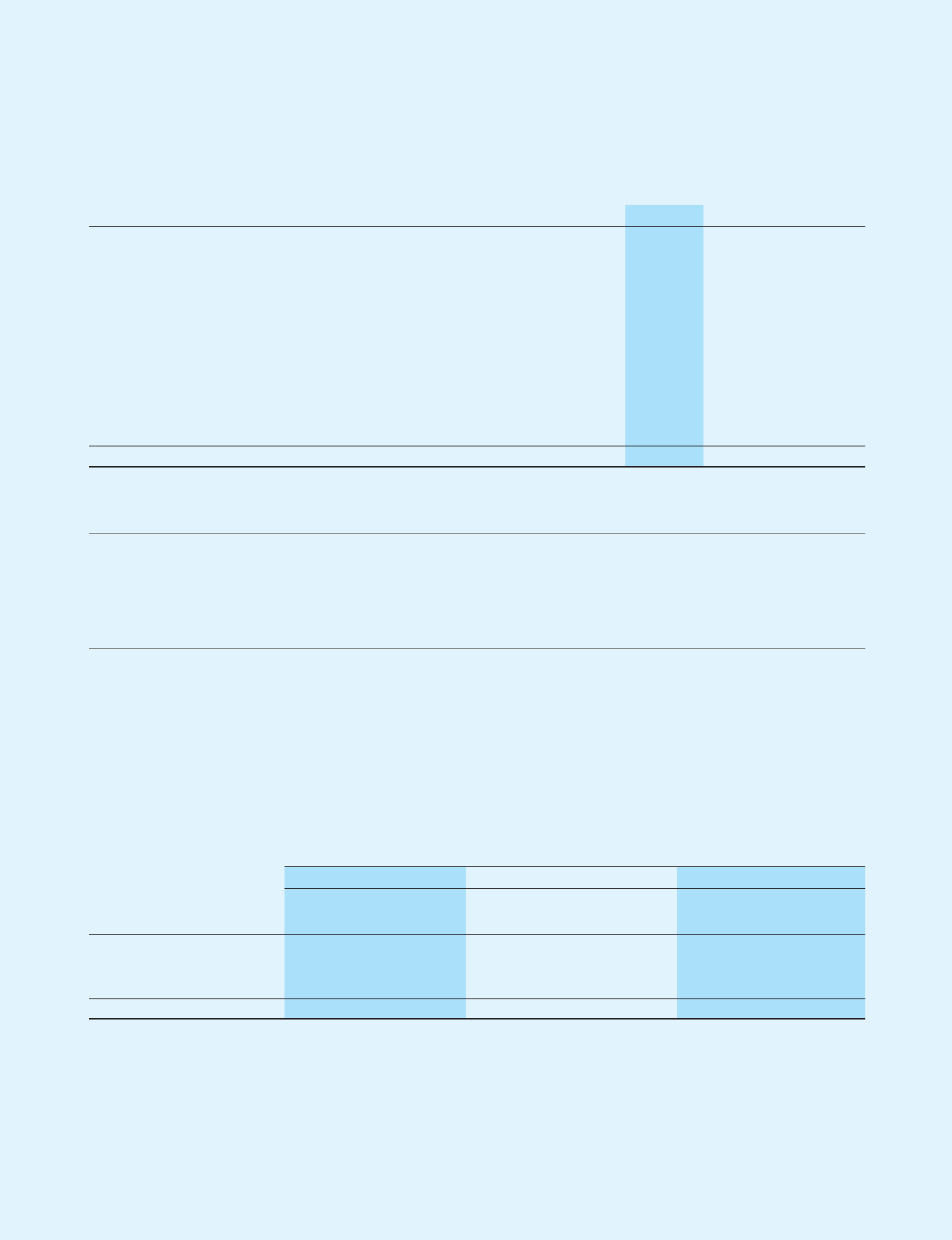

A reconciliation between the normal effective statutory tax rates and the actual effective tax rates reflected in the accompanying

consolidated statements of income for the years ended March 31, 2005, 2004 and 2003 was as follows:

2005 2004 2003

Normal effective statutory tax rate 40.4% 41.7% 41.7%

Lower income tax rates applicable to income in certain foreign countries (13.8) (12.4) (13.5)

Expenses not permanently deductible for income tax purposes 0.4 0.7 0.6

Per capita portion 0.1 0.2 0.4

Non-taxable dividend income (2.6) (2.1) (2.1)

Intercompany cash dividend and transactions 0.8 1.6 2.1

Equity in earnings of associated companies (1.8) (1.2) (0.6)

Special tax credit on experiment and research expenses (0.8) (1.1)

Adjustments of deferred tax assets and liabilities due to change the normal effective

statutory tax rate 0.3

Other—net 0.3 1.1 1.3

Actual effective tax rate 23.0% 28.5% 30.2%

Research and development expenses charged to income for

the years ended March 31, 2005, 2004 and 2003 were ¥10,957

million ($102,402 thousand), ¥9,847 million and ¥8,681 million,

respectively.

No. 12 RESEARCH AND DEVELOPMENT EXPENSES

The Group leases certain machinery, computer equipment, office

space and other assets. Total rental expenses including lease

payments for the years ended March 31, 2005, 2004 and 2003

were ¥5,802 million ($54,224 thousand), ¥6,748 million and

¥7,967 million, respectively. For the year ended March 31, 2004,

the Group recorded an impairment loss of ¥276 million on certain

leased property held under finance leases that do not transfer

ownership and an allowance for impairment loss on leased

property, which is included in current liabilities.

No. 13 LEASES

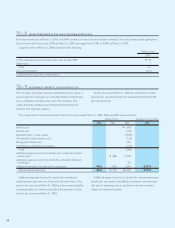

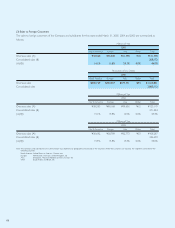

Pro forma information of leased property such as acquisition cost, accumulated depreciation, accumulated impairment loss, obligation

under finance lease and depreciation expense of finance leases that do not transfer ownership of the leased property to the lessee on an

“as if capitalized” basis for the years ended March 31, 2005 and 2004 was as follows:

Millions of Yen Thousands of U.S. Dollars

2005 2004 2005

Machinery Furniture Machinery Furniture Machinery Furniture

and and and and and and

Vehicles Equipment Total Vehicles Equipment Total Vehicles Equipment Total

Acquisition cost ¥3,796 ¥2,409 ¥6,205 ¥4,064 ¥3,277 ¥7,341 $35,477 $22,514 $57,991

Accumulated depreciation 2,191 1,667 3,858 2,037 2,201 4,238 20,477 15,579 36,056

Accumulated impairment loss 203 203 276 276 1,897 1,897

Net leased property ¥1,605 ¥ 539 ¥2,144 ¥2,027 ¥ 800 ¥2,827 $15,000 $ 5,038 $20,038