Pentax 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

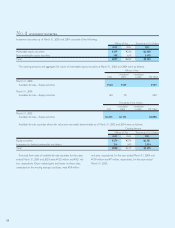

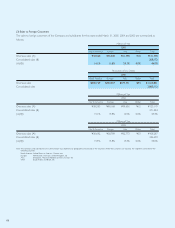

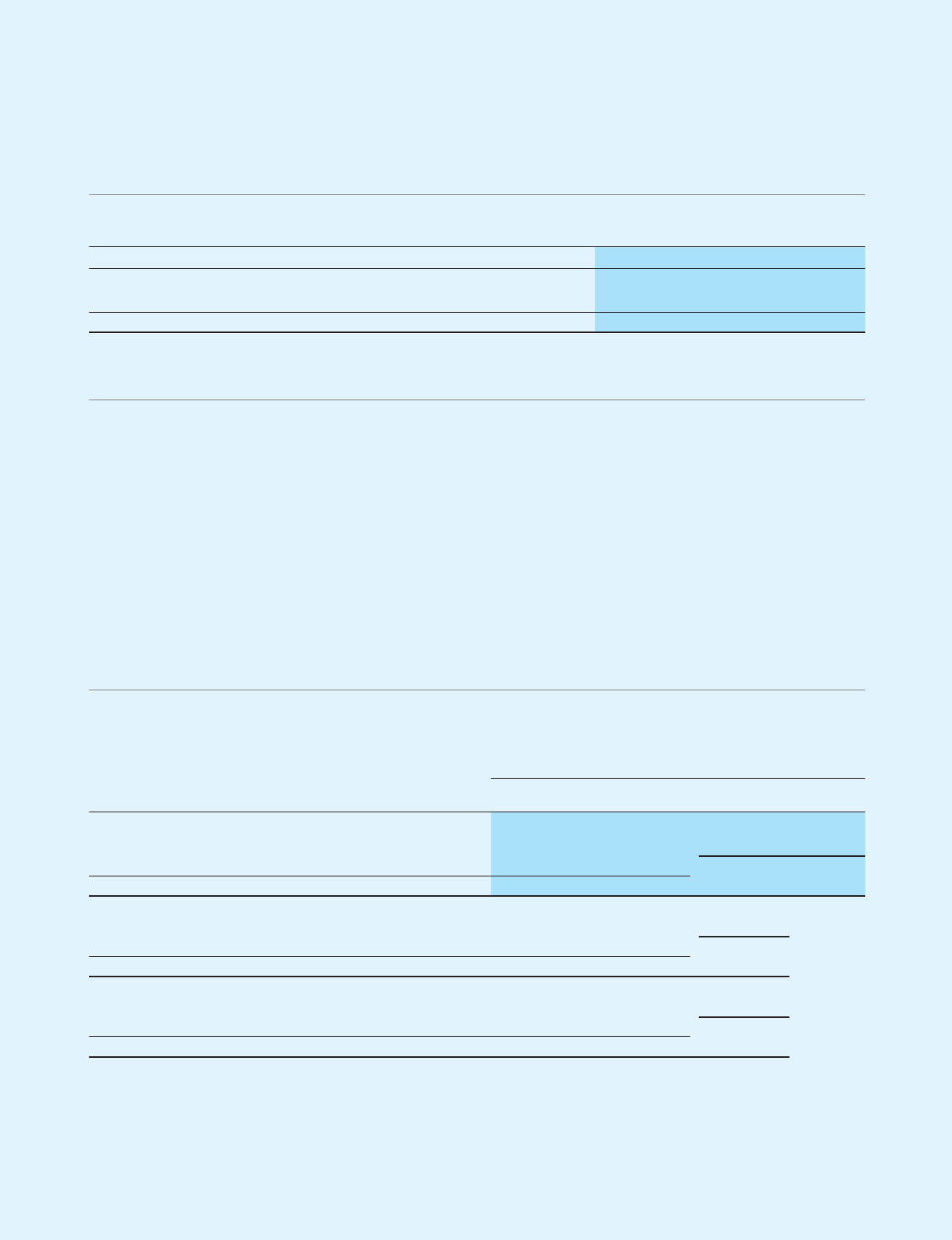

No. 15 CONTINGENT LIABILITIES

At March 31, 2005, the Group had the following contingent liabilities:

Millions of Yen Thousands of U.S. Dollars

2005 2005

Guarantees of borrowings and lease obligations for customers ¥1,364 $12,747

Guarantees of borrowings for the Group’s employees 547

Total ¥1,369 $12,794

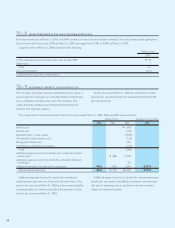

The Group enters into foreign currency forward contracts to

hedge foreign currency exchange risk associated with certain

assets and liabilities denominated in foreign currencies.

All derivative transactions are entered into to hedge foreign

currency exposures incorporated within its business. Accordingly,

market risk in these derivatives is basically offset by opposite

movements in the value of hedged assets or liabilities.

Because the counterparties to these derivatives are limited

to major international financial institutions, the Group does not

anticipate any losses arising from credit risk.

Derivative transactions entered into by the Group have been

made in accordance with internal policies which regulate the

authorization and credit limit amount.

Foreign currency forward contracts which qualify for hedge

accounting for the years ended March 31, 2005 and 2004 and

such amounts which are assigned to the associated assets or

liabilities and are recorded on the balance sheets at March 31,

2005 and 2004, are not subject to disclosure of market value

information.

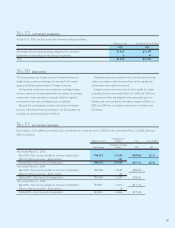

No. 16 DERIVATIVES

Reconciliation of the differences between basic and diluted net income per share (“EPS”) for the years ended March 31, 2005, 2004 and

2003 is as follows:

Thousands of

Millions of Yen Shares Yen U.S. Dollars

Weighted-Average

Net Income Shares EPS EPS

Year ended March 31, 2005:

Basic EPS—Net income available to common shareholders ¥64,072 110,690 ¥578.84 $5.41

Effect of dilutive securities—Stock options 253

Diluted EPS—Net income for computation ¥64,072 110,943 ¥577.52 $5.40

Year ended March 31, 2004:

Basic EPS—Net income available to common shareholders ¥39,500 112,545 ¥350.96

Effect of dilutive securities—Stock options 129

Diluted EPS—Net income for computation ¥39,500 112,674 ¥350.56

Year ended March 31, 2003:

Basic EPS—Net income available to common shareholders ¥19,851 116,014 ¥171.10

Effect of dilutive securities—Stock options 14

Diluted EPS—Net income for computation ¥19,851 116,028 ¥171.08

No. 17 NET INCOME PER SHARE