Pentax 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

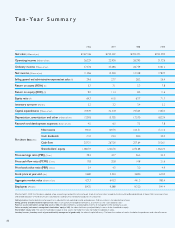

Net sales in the Electro-Optics division rose 22.6% year on year to ¥165,664

million. In mask blanks for semiconductor production, demand was strong for

high-precision products such as phase shift mask blanks in response to steady

growth in high-precision products for the semiconductor market. Sales of

photomasks for semiconductor production increased as a result of robust

demand throughout the year for high-precision products and next-generation

products for R&D. In large-scale LCD photomasks, the market grew severe as

price reductions were implemented in the market for LCD panels during the

second half of the year. With demand for LCD televisions expanding and LCD

panel manufacturers continuing to launch new models, however, demand for

masks remained strong and net sales were steady, centered on masks for

large-scale panels.

In glass disks for HDDs, in addition to steady demand for disks for laptop

computers, demand for small-size glass disks for applications such as portable

music players expanded strongly. Net sales were also boosted substantially

compared to the previous consolidated fiscal year by the addition of the glass

disk business of NIPPON SHEET GLASS CO., LTD., which was transferred to

Hoya in March 2004. In optical glass products, sales of molded aspheric lenses

and other optical lenses fared well, reflecting growth in the digital camera

market in the first half of the consolidated fiscal year under review. Although

affected greatly by inventory adjustments because of oversupply in the market

during the second half, net sales increased year on year for the full year.

Operating income of the Electro-Optics division rose 40.1% to ¥63,290

million. In the first half, conditions of strong demand relative to supply capacity

continued for many products, boosting profit margins to very high levels

because plant capacity utilization rates were high. Hoya expanded supply

capacity in the second half of the year through capital investment, but demand

for some products slowed, causing profit margins to erode. Throughout the

year, demand for high-value-added products was strong for every product, and

the operating margin for the full year increased by 4.7 percentage points to

38.1%.

As indicated in the graph for “Sales Growth and Profitability by Business

Segment” (“the graph”), the growth rate for Electro-Optics division net sales

was higher than the consolidated average growth rate for net sales of 13.5%

(the circle is above the Consolidated Basis line), and the position of the circle

shifted right as the operating margin improved from the previous consolidated

fiscal year.

By quarter, the operating margin was 38.9% in the first quarter, 40.5% in

the second quarter, 37.3% in the third quarter and 35.5% in the fourth quarter.

Hoya increased capital investment in the Electro-Optics division

substantially during the fiscal year, boosting investment by 43.7% to ¥31,962

million. Capital investments to construct new plants and enhance existing

equipment were made to improve production capacity for products such as

large-scale LCD photomasks, glass disks for HDDs and optical lenses.

Net sales for the Photonics division jumped 161.2% to ¥10,749 million.

The main factor behind this net sales increase was the transfer of HOYA

CANDEO OPTRONICS CORPORATION, which was part of the Electro-

Optics division until the end of the previous consolidated fiscal year, to the

Photonics division at the start of the consolidated fiscal year under review. At

the end of the first quarter of the previous consolidated fiscal year, this

company was converted from a company accounted for by the equity

method to a consolidated subsidiary.

Segment Overview

Information Technology (Electro-Optics and Photonics Division)

(%)

40

20

0

(Millions of yen)

200,000

150,000

100,000

50,000

0

2003 2004 2005

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

111,461

34,414

30.8

114,877

13,129

10,444

135,071

45,170

33.4

132,240

13,205

22,247

165,664

63,290

38.1

162,638

14,730

31,962

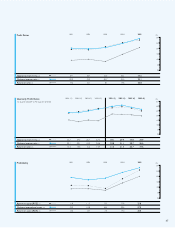

Sales Growth and Profitability by Business Segment

Fiscal year ended March 31, 2005 (Compared with the previous fiscal year) Sales Growth Ratio (%)

35

25

15

5

-5

-15

1520253035 4045

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 64 Segment Information.

Electro-Optics Division

Operating Income Ratio (%)

Electro-Optics

Health Care

Vision Care

Size of circle shows the volume of operating income.

Consolidated Basis

Consolidated Basis