Pentax 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

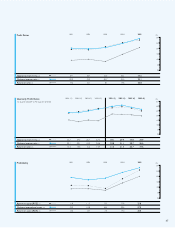

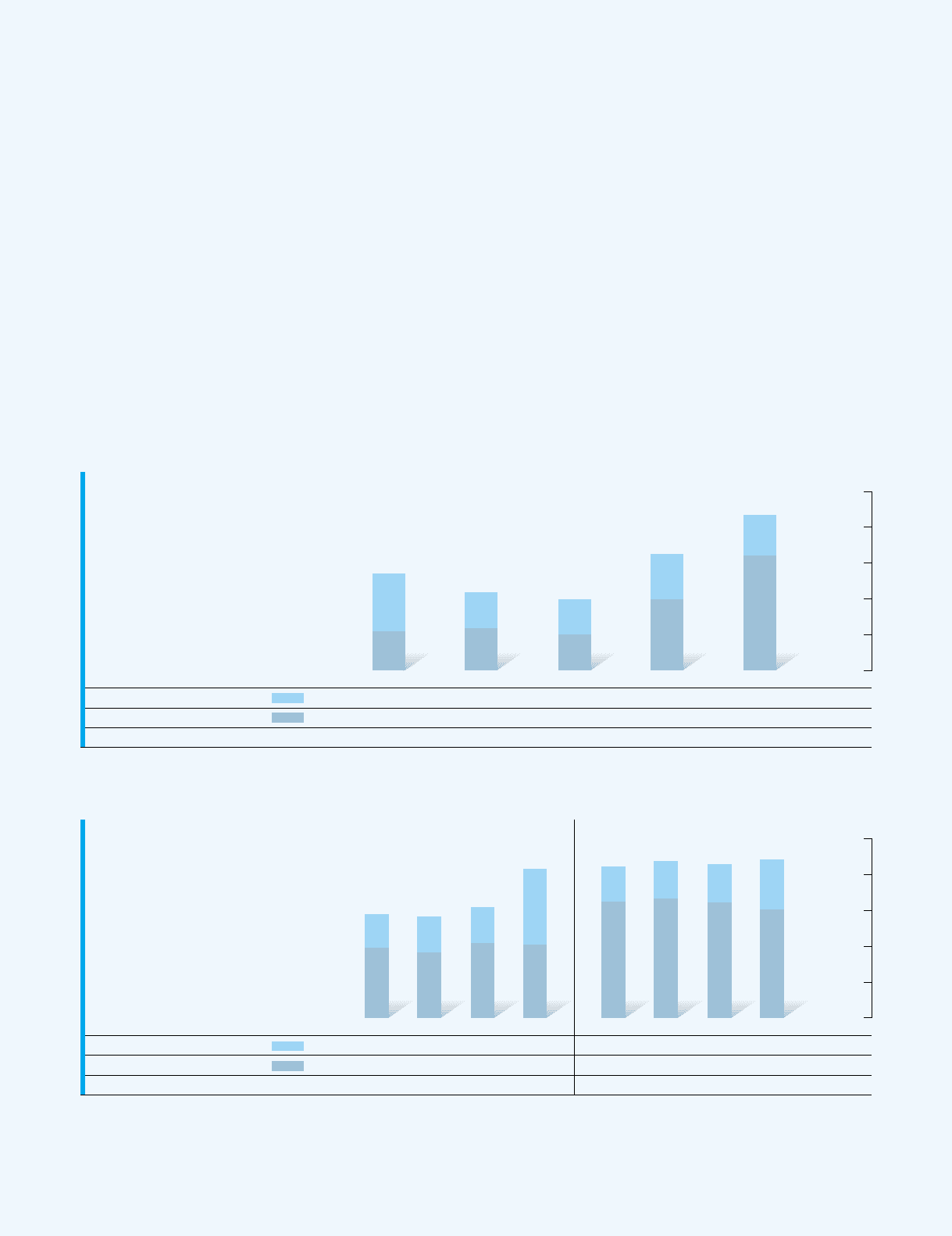

Depreciation, amortization and other (Millions of yen)

Net income (Millions of yen)

Cash flows (Millions of yen)

32,138

21,860

53,998

20,105

23,741

43,846

19,792

20,038

39,830

25,328

39,549

64,877

22,520

64,135

86,655

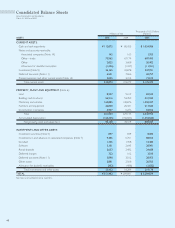

Cash Flows

Based on the operating results previously discussed in the paragraphs

on “Net Sales” and “Net Income,” net cash provided by operating

activities decreased by ¥2,744 million to ¥76,000 million. This mainly

reflects the fact that income before income taxes and minority interests

increased by ¥27,970 million to ¥83,466 million and depreciation and

amortization expense increased by ¥1,673 million to ¥21,661 million.

Regarding cash used in operating activities, major items included an

increase in notes and accounts receivable of ¥5,393 million (¥396

million more than in the previous consolidated fiscal year) an increase in

inventories of ¥2,526 million (¥2,748 million more than in the previous

consolidated fiscal year) and income taxes paid of ¥23,588 million

(¥16,708 million more than in the previous consolidated fiscal year).

Net cash used in investing activities rose by ¥7,185 million to

¥35,524 million. This mainly reflected an increase in purchases of

property, plant and equipment, which rose by ¥10,182 million to

¥33,394 million.

Net cash used in financing activities was ¥11,692 million, primarily

for payment of dividends, which increased by ¥3,658 million to ¥12,246

million. Because net cash used in financing activities in the previous

consolidated fiscal year was ¥42,853 million, which included substantial

funds used for a net increase in treasury stock, net cash used in financing

activities declined by ¥31,161 million year on year.

As a result of the above, the balance of cash and cash equivalents

at the end of the consolidated fiscal year under review increased by

¥32,450 million to ¥112,875 million.

Cash Flows (Millions of yen)

100,000

80,000

60,000

40,000

20,000

0

2001 2002 2003 2004 2005

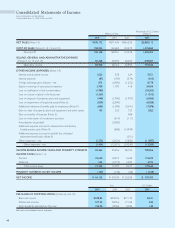

Quarterly Cash Flows

1st quarter of 2004 to 4th quarter of 2005

(Millions of yen)

25,000

20,000

15,000

10,000

5,000

0

2004-1Q 2004-2Q 2004-3Q 2004-4Q 2005-1Q 2005-2Q 2005-3Q 2005-4Q

Depreciation, amortization and other (Millions of yen)

Net income (Millions of yen)

Cash flows (Millions of yen)

4,645

9,795

14,440

5,018

9,129

14,147

5,027

10,419

15,446

10,638

10,206

20,844

4,928

16,223

21,151

5,252

16,671

21,923

5,368

16,123

21,491

6,972

15,118

22,090

Note: Depreciation, amortization and other includes depreciation, amortization of goodwill, and loss on impairment of long-lived assets.

Note: Depreciation, amortization and other includes depreciation, amortization of goodwill, and loss on impairment of long-lived assets.