Pentax 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

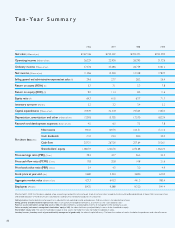

Effective April 1, 2002, the Company adopted a new accounting standard for net income per share of common stock issued by the Accounting Standards Board of Japan. Net income per share

and related data prior to that date are also calculated according to the standard for purposes of comparison.

Ordinary income: Income before income taxes that is adjusted for non-operating income and expenses. Ordinary income is not reported net of taxes.

Selling, general and administrative expenses/net sales: A calculation of management efficiency, also known as the ”sales expense ratio.“

Return on assets (net income/ average total assets x 100): An index of efficiency and profitability in terms of management of the Company’s assets.

Return on equity (net income/ average total shareholders’ equity x 100): An index of efficiency and profitability in terms of the shareholders’ equity.

Shareholders’ equity ratio: The ratio of shareholders’ equity to total assets; the higher the ratio, the higher the degree of safety.

Inventory turnover (inventory assets at year-end/monthly average cost of goods sold): An index of capital efficiency. The fewer the number of months, the better the production and sales efficiencies.

Ten-Year Summary

Net sales (Millions of yen)

Operating income (Millions of yen)

Ordinary income (Millions of yen)

Net income (Millions of yen)

Selling, general and administrative expenses/net sales

(%)

Return on assets (ROA) (%)

Return on equity (ROE) (%)

Equity ratio (%)

Inventory turnover (Months)

Capital expenditures (Millions of yen)

Depreciation, amortization and other (Millions of yen)

Research and development expenses (Billions of yen)

Net income

Cash dividends

Cash flow

Shareholders’ equity

Price earnings ratio (PER) (Times)

Price cash flow ratio (PCFR) (Times)

Price book value ratio (PBR) (Times)

Stock price at year-end (Yen)

Aggregate market value (Billions of yen)

Employees (Persons)

Per share data (Yen)

¥193,402

32,936

35,086

15,300

27.7

7.1

11.4

61.0

3.2

32,318

15,705

6.0

129.70

23.0

267.00

1,220.70

42.7

20.8

4.5

5,540

643.3

9,588

¥167,106

26,229

27,376

11,056

29.6

5.7

9.0

64.3

3.2

19,439

13,018

4.5

93.32

21.0

207.31

1,082.54

39.4

17.8

3.4

3,680

427.3

8,435

¥193,473

26,395

26,759

12,348

28.2

5.3

8.5

63.7

3.4

19,504

17,570

7.5

104.51

28.0

257.64

1,270.68

36.4

14.8

3.0

3,800

441.3

9,320

¥201,290

31,726

33,612

17,837

26.4

7.8

11.6

71.7

3.2

13,654

18,234

7.8

151.10

30.0

310.61

1,362.24

44.5

21.6

4.9

6,720

780.4

9,414

1996 1997 1998 1999