Pentax 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

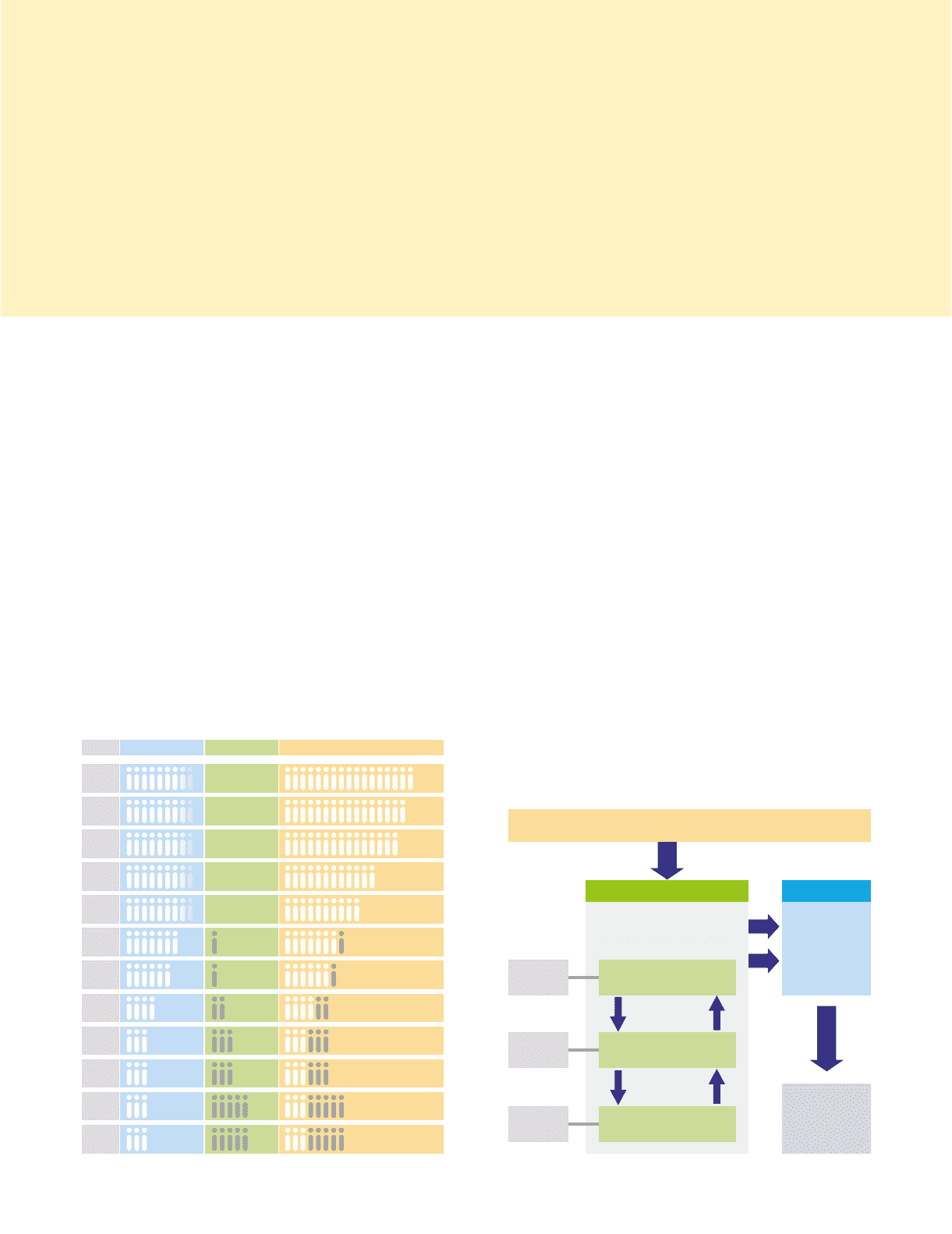

Transitions in the Board of Directors

Corporate Governance Structure

1989

1990

1991

1993

1994

1995

1999

2000

2001

2002

2003

2004

17

16

15

12

10

8

7

6

6

6

8

8

17

16

15

12

10

Year

Internal directors

Outside directors

Total number of directors

Reducing the Number of Directors and

Instituting a Majority of Outside Directors

To guard against the potential for stagnation in the Board of

Directors system, and to ensure lively debate, Hoya has since

1989 been reducing the number of its directors. The number of

directors has been more than halved, from 17 in 1989 to eight in

1995, and the first outside directors were appointed during this

period. In 2003, of the eight directors, a majority of five were

outside directors. The three internal directors serve concurrently

as executive officers, engaged in operation of the business. With

an organizational structure that incorporates a divisional

organization and internal companies, Hoya has proceeded to

devolve authority from executive officers to the head of each

business division to a great extent. Under this system, the head of

each business division is responsible for operational execution.

The Move to the Company-with-Committees

System

I

n June 2003, Hoya instituted the company-with-committees system.

Three committees have been established. Proposals to appoint

directors and executive officers or relieve them of their posts are

decided by the Nomination Committee. The Compensation

Committee determines fees paid to directors and executive officers.

The Audit Committee receives reports from an independent

auditor and scrutinizes financial statements, and through observation

and scrutiny of internal control, it audits the business conditions and

property of the Company. The membership of all three committees

is drawn entirely from the five outside directors. This has given Hoya

a system whereby the external directors, who stand for the

shareholders, would even be able to relieve the CEO of his post.

Hoya also strives to ensure that sufficient staff members are

available to assist its external directors. Three such employees are

assigned exclusively to secretariat duties with the Audit Committee,

and one each, with a background in human resource administration,

holds concurrent positions with the Nomination Committee and

the Compensation Committee.

Internal Directors: 3

(serving concurrently as

executive officers)

Outside directors: 5

Collaboration and

mutual monitoring

Collaboration and

mutual monitoring

Divisions

ElectionSupervision and advice

(Board of Directors)

(Executive Officers)

Compensation Committee

5 outside directors

Nomination Committee

5 outside directors

Audit Committee

5 outside directors

President

Executive Officers

(3 internal directors)

General Meeting of Shareholders

Compensation

Committee

Secretariat

Nomination

Committee

Secretariat

Audit

Committee

Secretariat

Execution of

operations

Corporate Governance

Hoya treats corporate governance as a key management principle, and has instituted many reforms based on corporate governance ideals.

Based on the fundamental vision that “companies are owned by their shareholders,” we ensure that Hoya is not managed according to

the internal guidelines held by only a small part of the management team. Instead, we have set up a system under which independent

observers take the standpoint of shareholders, undertaking appropriate checks. At the same time, management and operational areas

have been separated, with the objective of accelerating decision-making processes.

Election