Pentax 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

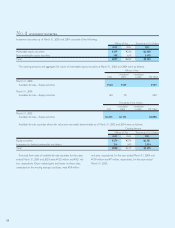

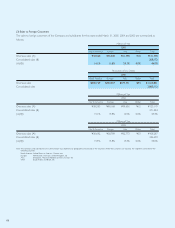

The Company and its domestic subsidiaries are subject to

Japanese national and local income taxes which, in the aggregate,

resulted in a normal effective statutory tax rate of approximately

40.4% for the year ended March 31, 2005 and 41.7% for the years

ended March 31, 2004 and 2003.

On March 31, 2003, a tax reform law was enacted in Japan

which changed the normal effective statutory tax rate from

approximately 41.7% to 40.4%, effective for years beginning

April 1, 2004. The effect of this change on deferred taxes in the

consolidated statements of income for the year ended March 31,

2003 was a decrease of approximately ¥94 million.

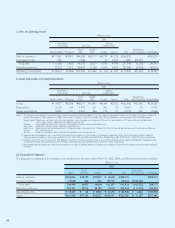

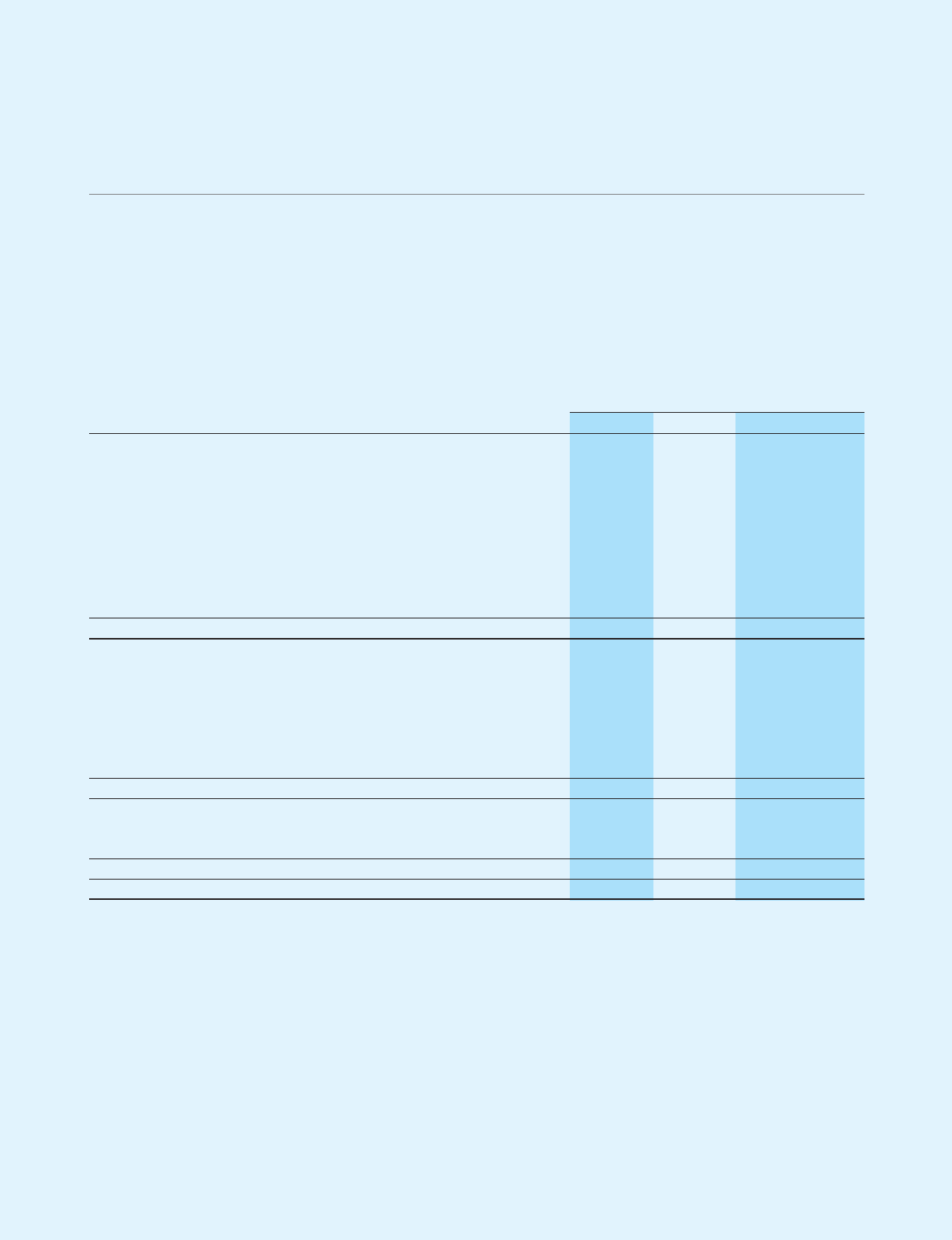

No. 11 INCOME TAXES

The tax effects of significant temporary differences and loss carryforwards which resulted in deferred tax assets and liabilities at March 31,

2005 and 2004 were as follows:

Millions of Yen Thousands of U.S. Dollars

2005 2004 2005

Current:

Deferred tax assets:

Inventories—intercompany unrealized profits ¥1,711 ¥1,604 $15,991

Accrued bonuses to employees 1,529 1,410 14,290

Accrued enterprise taxes 692 1,201 6,467

Accrued expenses 498 171 4,654

Inventories—loss on write-down 455 4,252

Amortization of goodwill 285 1,493 2,664

Other 1,331 1,187 12,439

Total ¥6,501 ¥7,066 $60,757

Non-current:

Deferred tax assets:

Amortization of goodwill and property, plant and equipment ¥1,876 ¥2,069 $17,533

Loss on impairment of long-lived assets 862 824 8,056

Loss on closure of plant in the fiscal year 510 4,766

Allowance for doubtful receivables 117 182 1,093

Other 624 859 5,832

Total 3,989 3,934 37,280

Deferred tax liabilities:

Reserves for special depreciation and other 700 756 6,542

Other 191 166 1,785

Total 891 922 8,327

Net deferred tax assets ¥3,098 ¥3,012 $28,953