Pentax 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

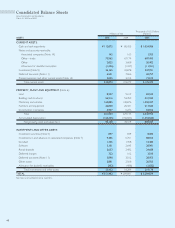

Financial Position

In terms of assets at the end of the consolidated fiscal year under

review, cash and cash equivalents grew 40.3% year on year to ¥112,875

million, and notes and accounts receivable rose 8.2% to ¥75,296 million.

These were the major factors behind the large increase in current

assets, which grew 20.5% to ¥232,872 million. Because property, plant

and equipment increased 21.5% to ¥95,158 million and investments and

other assets rose 28.2% to ¥23,452 million, noncurrent assets expanded

22.8% to ¥118,610 million. Total assets increased 21.2%, to ¥351,482

million.

Current liabilities increased 3.7% to ¥70,792 million. This reflected

higher accrued expenses and notes and accounts payable, although

income taxes payable fell 30.4% to ¥10,023 million. Long-term liabilities

rose 1.9% to ¥1,970 million. Total liabilities were ¥72,762 million, up 3.7%.

Retained earnings increased 8.5%, or ¥21,079 million, to ¥268,255

million, reflecting the increase in net income of ¥64,135 million and the

decrease of ¥43,056 million comprising dividends paid of ¥12,241

million, retirement of treasury stock of ¥30,702 million, and other items.

In addition, foreign currency translation adjustments shrank by ¥6,138

million, and treasury stock declined ¥31,625 million. As a result, total

shareholders’ equity rose 26.9% to ¥277,889 million. The shareholders’

equity ratio increased by 3.6 percentage points, to 79.1%, from 75.5%.

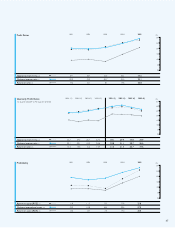

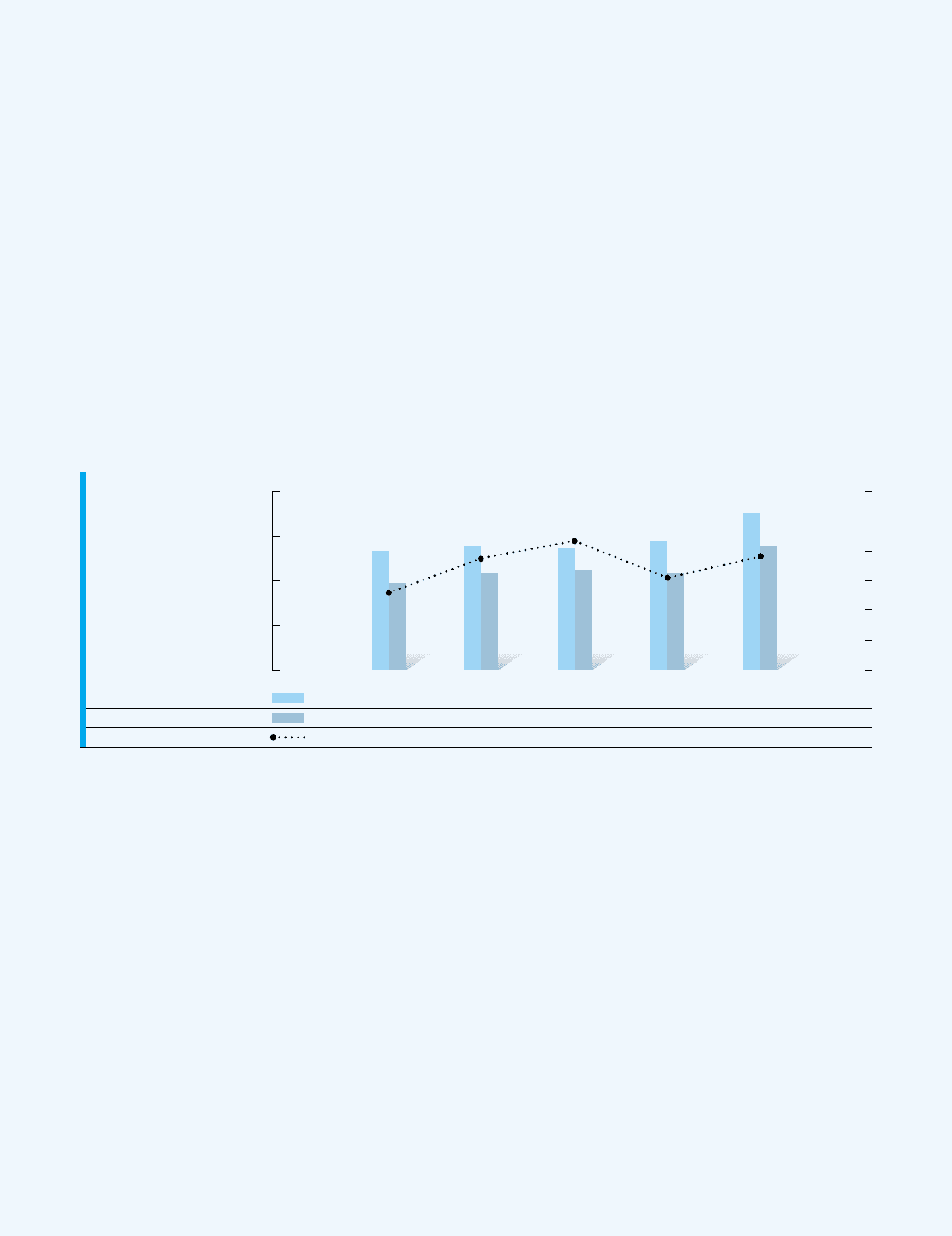

Total Assets,

Shareholders’ Equity and

Shareholders’ Equity Ratio

(Millions of yen)

400,000

300,000

200,000

100,000

0

(%)

90

85

80

75

70

65

60

2001 2002 2003 2004 2005

Total assets (Millions of yen)

Shareholders’ equity (Millions of yen)

Shareholders’ equity ratio (%)

267,611

195,333

73.0

278,068

219,180

78.8

274,289

224,219

81.7

289,887

218,979

75.5

351,482

277,889

79.1