OfficeMax 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Credit Agreements

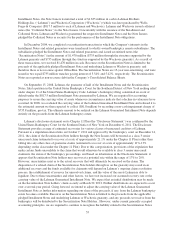

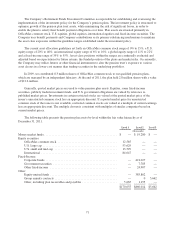

On October 7, 2011, the Company entered into a Second Amended and Restated Loan and Security Agreement

(the “North American Credit Agreement”) with a group of banks. The North American Credit Agreement amended

both our existing credit agreement that we are a party to along with certain of our subsidiaries in the U.S. (the “U.S.

Credit Agreement”) and our existing credit agreement to which our subsidiary in Canada is a party (the “Canadian

Credit Agreement”) and consolidated them into a single credit agreement. The North American Credit Agreement

permits the Company to borrow up to a maximum of $650 million (U.S. dollars), of which $50 million is allocated

to the Company’s Canadian subsidiary and $600 million is allocated to the Company and its other participating U.S.

subsidiaries, in each case subject to a borrowing base calculation that limits availability to a percentage of eligible

trade and credit card receivables plus a percentage of the value of eligible inventory less certain reserves. The North

American Credit Agreement may be increased (up to a maximum of $850 million) at the Company’s request and

the approval of lenders participating in the increase, or may be reduced from time to time at the Company’s request,

in each case according to the terms detailed in the North American Credit Agreement. Letters of credit, which may

be issued under the North American Credit Agreement up to a maximum of $250 million, reduce available

borrowing capacity. At the end of fiscal year 2011, the Company was in compliance with all covenants under the

North American Credit Agreement. The North American Credit Agreement will expire on October 7, 2016.

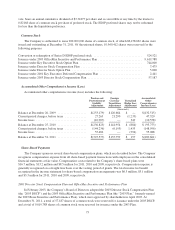

Borrowings under the U.S. Credit Agreement were subject to interest at rates based on either the prime rate

or the London Interbank Offered Rate (“LIBOR”). Margins were applied to the applicable borrowing rates and

letter of credit fees under the U.S. Credit Agreement depending on the level of average availability. Fees on

letters of credit issued under the U.S. Credit Agreement were charged at a weighted average rate of 0.875%. The

Company was also charged an unused line fee of 0.25% under the U.S. Credit Agreement on the amount by

which the maximum available credit exceeded the average daily outstanding borrowings and letters of credit.

Borrowings under the North American Credit Agreement are subject to interest at rates based on either the

prime rate, the federal funds rate, LIBOR or the Canadian Dealer Offered Rate. An additional percentage, which

varies depending on the level of average borrowing availability, is added to the applicable rates. Fees on letters of

credit issued under the North American Credit Agreement are charged at rates between 1.25% and 2.25%

depending on the type of letter of credit (i.e., stand-by or commercial) the level of average borrowing

availability. The Company is also charged an unused line fee of between 0.375% and 0.5% on the amount by

which the maximum available credit exceeds the average daily outstanding borrowings and letters of credit. The

fees on letters of credit were 1.75% and the unused line fee was 0.5% at December 31, 2011. Thereafter, the rate

will vary depending on the level of average borrowing availability and type of letters of credit.

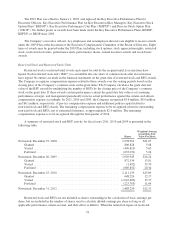

On March 15, 2010, the Company’s five wholly-owned subsidiaries based in Australia and New Zealand

entered into a Facility Agreement (the “Australia/New Zealand Credit Agreement”) with a financial institution

based in those countries. The Australia/New Zealand Credit Agreement permits the subsidiaries in Australia and

New Zealand to borrow up to a maximum of A$80 million subject to a borrowing base calculation that limits

availability to a percentage of eligible accounts receivable plus a percentage of the value of certain owned

properties, less certain reserves. At the end of fiscal year 2011, the subsidiaries in Australia and New Zealand

were in compliance with all covenants under the Australia/New Zealand Credit Agreement. The Australia/New

Zealand Credit Agreement expires on March 15, 2013.

64