OfficeMax 2011 Annual Report Download - page 66

Download and view the complete annual report

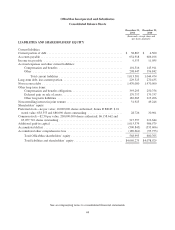

Please find page 66 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our Consolidated Balance Sheet as of December 31, 2011 includes $393.3 million of long-term liabilities

associated with our retirement and benefit and other compensation plans and $362.4 million of other long-term

liabilities. Certain of these amounts have been excluded from the above table as either the amounts are fully or

partially funded, or the timing and/or the amount of any cash payment is uncertain. Actuarially-determined

liabilities related to pension and postretirement benefits are recorded based on estimates and assumptions. Key

factors used in developing estimates of these liabilities include assumptions related to discount rates, rates of

return on investments, future compensation costs, healthcare cost trends, benefit payment patterns and other

factors. Changes in assumptions related to the measurement of funded status could have a material impact on the

amount reported. Pension obligations in the table above represent the estimated, minimum contributions required

per IRS funding rules.

In accordance with an amended and restated joint venture agreement, the minority owner of Grupo

OfficeMax, our joint-venture in Mexico, can elect to require OfficeMax to purchase the minority owner’s 49%

interest in the joint venture if certain earnings targets are achieved. Earnings targets are calculated quarterly on a

rolling four-quarter basis. Accordingly, the targets may be achieved in one quarter but not in the next. If the

earnings targets are achieved and the minority owner elects to require OfficeMax to purchase the minority

owner’s interest, the purchase price is based on the joint venture’s earnings and the current market multiples of

similar companies. At the end of 2011, Grupo OfficeMax met the earnings targets and the estimated purchase

price of the minority owner’s interest was $27.6 million. The decrease in the estimated purchase price from the

prior year is attributable to lower market multiples for similar companies as of the measurement date. As the

estimated purchase price was less than the carrying value of the noncontrolling interest as of the end of the year,

the Company reduced the noncontrolling interest to the carrying value, with the offset recorded to additional

paid-in capital. There is no impairment relating to the assets of the joint venture as the estimated future cash

flows support the overall carrying value of its assets.

In addition to the contractual obligations quantified in the table above, we have other obligations for goods

and services entered into in the normal course of business. These contracts, however, are either not enforceable

or legally binding or are subject to change based on our business decisions.

Off-Balance-Sheet Activities and Guarantees

Note 15, “Commitments and Guarantees,” of the Notes to Consolidated Financial Statements in “Item 8.

Financial Statements and Supplementary Data” in this Form 10-K describes certain of our off-balance sheet

arrangements as well as the nature of our guarantees, including the approximate terms of the guarantees, how the

guarantees arose, the events or circumstances that would require us to perform under the guarantees and the

maximum potential undiscounted amounts of future payments we could be required to make.

Seasonal Influences

Our business is seasonal, with Retail showing a more pronounced seasonal trend than Contract. Sales in the

second quarter are historically the slowest of the year. Sales are stronger during the first, third and fourth quarters

which include the important new-year office supply restocking month of January, the back-to-school period and

the holiday selling season, respectively.

Disclosures of Financial Market Risks

Financial Instruments

Our debt is predominantly fixed-rate. At December 31, 2011, the estimated current fair value of our debt,

based on quoted market prices when available or then-current interest rates for similar obligations with like

maturities, including the timber notes, was approximately $557 million less than the amount of debt reported in

the Consolidated Balance Sheets. As previously discussed, there is no recourse against OfficeMax on the

34