OfficeMax 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources

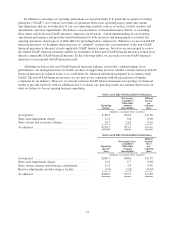

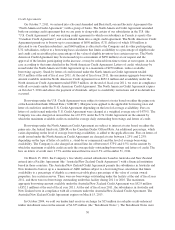

At the end of fiscal year 2011, the total liquidity available for OfficeMax was $1,060.3 million. This

includes cash and cash equivalents of $427.1 million, including $126.2 million in foreign cash balances, and

borrowing availability of $633.2 million. The borrowing availability included $580.3 million from our credit

agreement associated with the Company and certain of our subsidiaries in the U.S., Puerto Rico and Canada and

$52.9 million from our credit agreement associated with our subsidiaries in Australia and New Zealand. At the

end of fiscal year 2011, the Company was in compliance with all covenants under the two credit agreements. The

credit agreement associated with the Company and certain of our subsidiaries in the U.S., Puerto Rico and

Canada expires on October 7, 2016 and the credit agreement associated with our subsidiaries in Australia and

New Zealand expires on March 15, 2013. At the end of fiscal year 2011, we had $268.2 million of short-term and

long-term recourse debt and $1,470.0 million of non-recourse timber securitization notes outstanding.

Under certain circumstances there are restrictions on our ability to repatriate certain amounts of foreign cash

balances. If the Company chose to repatriate certain unrestricted foreign cash balances, it could result in a

repatriation provision of approximately $2.5 million in excess of the amount already accrued and $4.0 million in

cash taxes due.

Our primary ongoing cash requirements relate to working capital, expenditures for property and equipment,

technology enhancements and upgrades, lease obligations, pension funding and debt service. We expect to fund

these requirements through a combination of available cash balance and cash flow from operations. We also have

revolving credit facilities as additional liquidity. The following sections of this Management’s Discussion and

Analysis of Financial Condition and Results of Operations discuss in more detail our operating, investing, and

financing activities, as well as our financing arrangements.

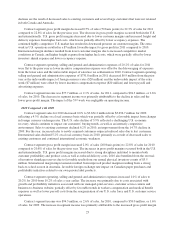

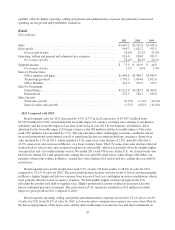

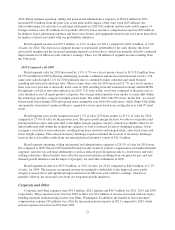

Operating Activities

Our operating activities provided cash of $53.7 million in 2011 compared to $88.1 million in 2010. Cash

from operations for 2011 was lower than the prior year primarily reflecting a lower level of earnings and $13.5

million of net tax payments in 2011 (international and state payments) versus net tax refunds of $5.0 million in

2010. Changes in accounts payable and accrued liabilities includes an unfavorable impact from paying the 2010

incentive compensation accrual in 2011 and recording a significantly reduced accrual for 2011 incentive

compensation expense. This change was offset by reduced legal and advertising payments in 2011.

Total company inventory decreased slightly year over year, primarily due to a decrease in international

inventory. In addition to the changes discussed above, accounts payable and accrued liabilities also reflected a

reduction in accounts payable from the timing and mix of purchases. Accounts receivable at the end of 2011 was

higher in our domestic businesses, primarily attributable to higher vendor receivables from increased vendor-

supported promotional activity, and increased customer receivables from a shift in the timing of sales.

Our operating activities generated cash of $88.1 million in 2010. Cash from operations in 2010 was net of

$44.4 million of payments of loans on company-owned life insurance policies (“COLI policies”) as well as $72.4

million of increased working capital primarily from larger holdings of our international inventories and the

timing of repayments and obligations.

Cash from operations in 2011 and 2010 included the impact of approximately $55 million and $58 million,

respectively, of incentive compensation payments made associated with the achievement of incentive plan

performance targets for 2010 and 2009, respectively. The Company accrued a minimal amount of incentive

compensation in 2011, as performance targets were generally not achieved. Therefore, 2012 incentive

compensation payments will be minimal.

28