OfficeMax 2011 Annual Report Download - page 88

Download and view the complete annual report

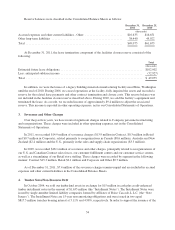

Please find page 88 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.guaranteed by Lehman until such time as the liability has been extinguished. The liability will be extinguished

when the Lehman Guaranteed Installment Note and the related guaranty are transferred to and accepted by the

Securitization Note holders. We expect that this will occur when the remaining guaranty claim of the

Securitization Note holders in the bankruptcy is resolved and as the Lehman assets are in the process of

distribution. Accordingly, we expect to recognize a non-cash gain equal to the difference between the carrying

amount of the Securitization Notes guaranteed by Lehman ($735.0 million at December 31, 2011) and the

carrying value of the Lehman Guaranteed Installment Note ($81.8 million at December 31, 2011) in a later

period when the liability is legally extinguished. The actual gain to be recognized in the future will be measured

based on the carrying amounts of the Lehman Guaranteed Installment Note and the Securitization Notes

guaranteed by Lehman at the date of settlement.

Any discussion of the Lehman bankruptcy in this document is strictly based on factual observations from

the bankruptcy cases and should not be interpreted as constituting legal analysis of or admission as to the

ultimate allowances of our claim based on the Lehman Guaranteed Installment Note or any Note Issuers’ claim

based on Collateral Notes, or the interplay thereof.

At the time of the sale of the timberlands in 2004, we generated a tax gain and recognized the related

deferred tax liability. The timber installment notes structure allowed the Company to defer the resulting tax

liability until 2020 ($529 million at December 31, 2011), the maturity date for the Installment Notes. Due to the

Lehman bankruptcy and note defaults, the recognition of the Lehman portion of the gain will be triggered when

the Lehman Guaranteed Installment Note and the related guaranty are transferred to and accepted by the

Securitization Note holders. At that time, we expect to reduce the estimated cash payment due by utilizing our

available alternative minimum tax credits.

Through December 31, 2011, we have received all payments due under the Installment Notes guaranteed by

Wachovia (the “Wachovia Guaranteed Installment Notes”), which have consisted only of interest due on the

notes, and made all payments due on the related Securitization Notes guaranteed by Wachovia, again consisting

only of interest due. As all amounts due on the Wachovia Guaranteed Installment Notes are current and we have

no reason to believe that we will not be able to collect all amounts due according to the contractual terms of the

Wachovia Guaranteed Installment Notes, the notes are stated in our Consolidated Balance Sheets at their original

principal amount of $817.5 million. The Installment Notes and Securitization Notes are scheduled to mature in

2020 and 2019, respectively. The Securitization Notes have an initial term that is approximately three months

shorter than the Installment Notes.

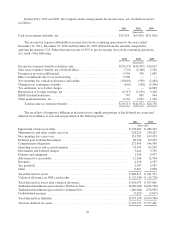

5. Intangible Assets and Other Long-lived Assets

Impairment Reviews and Charges

Intangible assets represent the values assigned to trade names, customer lists and relationships, noncompete

agreements and exclusive distribution rights of businesses acquired. Trade name assets have an indefinite life and

are not amortized. All other intangible assets are amortized on a straight-line basis over their expected useful

lives, which range from three to 20 years. Intangible assets with indefinite lives are not amortized but are tested

for impairment at least annually, or more frequently if events and circumstances indicate that the carrying

amount of the asset might be impaired, using a fair-value-based approach. An impairment loss is recognized to

the extent that the carrying amount exceeds the asset’s fair value. No impairment was recorded related to

intangible assets in 2011, 2010, or 2009.

In 2011, 2010 and 2009, the Company also performed impairment testing for the assets of individual retail

stores (“store assets” or “stores”), which consist primarily of leasehold improvements and fixtures, due to the

existence of indicators of potential impairment of these other long-lived assets. We performed the first step of

impairment testing for other long-lived assets on the store assets and determined that for some stores the

56