OfficeMax 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

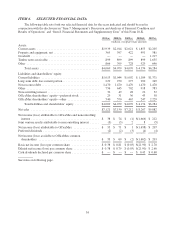

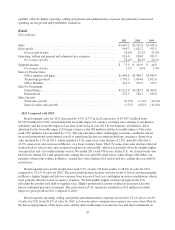

NON-GAAP RECONCILIATION FOR 2009(a)

Operating

income

(loss)

Net income

(loss)

available to

OfficeMax

common

shareholders

Diluted

income

(loss)

per

common

share

(millions, except per-share amounts)

As reported ............................................... $(4.0) $ (2.2) $(0.03)

Store asset impairment charge ................................ 17.6 10.0 0.12

Store closure and severance charges ........................... 49.3 30.0 0.39

Interest income from a legacy tax escrow ....................... — (2.7) (0.04)

Boise Cascade Holdings, L.L.C. distribution .................... — (1.6) (0.02)

Release of income tax uncertainty reserve ...................... — (14.9) (0.18)

As adjusted ............................................... $62.9 $ 18.6 $ 0.24

(a) Totals may not foot due to rounding.

These items are described in more detail in this Management’s Discussion and Analysis.

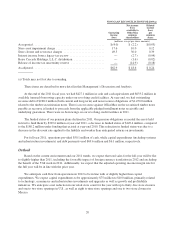

At the end of the 2011 fiscal year, we had $427.1 million in cash and cash equivalents and $633.2 million in

available (unused) borrowing capacity under our revolving credit facilities. At year-end, we had outstanding

recourse debt of $268.2 million (both current and long-term) and non-recourse obligations of $1,470.0 million

related to the timber securitization notes. There is no recourse against OfficeMax on the securitized timber notes

payable as recourse is limited to proceeds from the applicable pledged installment notes receivable and

underlying guarantees. There were no borrowings on our revolving credit facilities in 2011.

The funded status of our pension plans declined in 2011. Our pension obligations exceeded the assets held

in trust to fund them by $329.6 million at year-end 2011, a decrease in funded status of $149.4 million, compared

to the $180.2 million under funding that existed at year-end 2010. This reduction in funded status was due to a

decrease in the discount rate applied to the liability and weaker than anticipated returns on investments.

For full year 2011, operations provided $50.1 million of cash, while capital expenditures (including systems

and infrastructure investments) and debt payments used $69.6 million and $6.1 million, respectively.

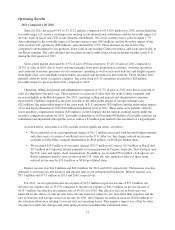

Outlook

Based on the current environment and our 2011 trends, we expect that total sales for the full year will be flat

to slightly higher than 2011, including the favorable impact of foreign currency translation in 2012 and excluding

the benefit of the 53rd week in 2011. Additionally, we expect that the adjusted operating income margin rate for

the full year will be in line with the prior year.

We anticipate cash flow from operations in 2012 to be in line with or slightly higher than capital

expenditures. We expect capital expenditures to be approximately $75 million to $100 million, primarily related

to technology, ecommerce and infrastructure investments and upgrades as well as growth and profitability

initiatives. We anticipate a net reduction in our retail store count for the year with up to thirty-five store closures

and one to two store openings in U.S., as well as eight to nine store openings and one to two store closures in

Mexico.

20