OfficeMax 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.declines are the result of decreased sales to existing customers and several large customers that were not retained

in both Canada and Australia.

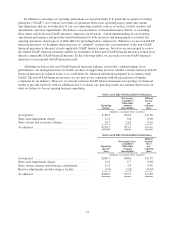

Contract segment gross profit margin decreased 0.5% of sales (50 basis points) to 22.3% of sales for 2011

compared to 22.8% of sales for the previous year. The decrease in gross profit margins occurred both in the U.S.

and internationally. U.S. gross profit margins decreased due to lower customer margins and increased freight and

delivery expenses from higher fuel costs, which were partially offset by lower occupancy expenses. The

continued highly competitive U.S. market has resulted in downward pressure on customer margins. The extra

week in U.S. operations resulted in a $7 million favorable impact to gross profit in 2011 compared to 2010.

International margin declines resulted from lower customer margins due to increased competitive market

conditions in Canada, and higher freight expense from higher fuel costs, which were partially offset by lower

inventory shrink expense and lower occupancy expense.

Contract segment operating, selling and general and administrative expenses of 20.2% of sales for 2011

were flat to the prior year as lower incentive compensation expense was offset by the deleveraging of expenses

from the lower sales and the unfavorable impact of sales/use tax settlements in 2010. Contract segment operating,

selling and general and administrative expenses of $731.8 million in 2011 decreased $0.9 million from the prior

year as the unfavorable impact of foreign currency rates ($20 million) and the unfavorable impact of the extra

week ($7 million) were offset by lower incentive compensation expense ($20 million) and lower payroll and

advertising expenses.

Contract segment income was $77.7 million, or 2.1% of sales, for 2011, compared to $94.3 million, or 2.6%

of sales, for 2010. The decrease in segment income was primarily attributable to the decline in sales and the

lower gross profit margin. The impact of the 53rd week was negligible on operating income.

2010 Compared with 2009

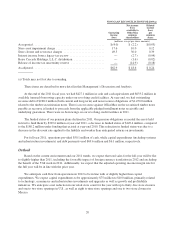

Contract segment sales for 2010 decreased 0.6% to $3,634.2 million from $3,656.7 million for 2009,

reflecting a 4.3% decline on a local currency basis which was partially offset by a favorable impact from changes

in foreign currency exchange rates. The U.S. sales decline of 3.9% reflected a challenging U.S. economic

recovery, which continues to impact our customers’ buying trends, as well as an intensely competitive

environment. Sales to existing customers declined 6.2% in 2010, an improvement from the 14.7% decline in

2009. For the year, increased sales to newly acquired customers outpaced reduced sales due to lost customers.

International sales declined 5.2% on a local currency basis in 2010, primarily as a result of decreased sales to

existing customers and continued international economic weakness.

Contract segment gross profit margin increased 2.0% of sales (200 basis points) to 22.8% of sales for 2010

compared to 20.8% of sales for the previous year. The increases in gross profit margins occurred both in the U.S.

and internationally. U.S. gross profit margins increased due to strong disciplines instituted to monitor both

customer profitability and product costs as well as reduced delivery costs. 2010 also benefited from the reversal

of inventory shrinkage reserves due to favorable results from our annual physical inventory counts of $3.5

million. International margin improvements resulted from improved product margins resulting from a strong

back-to-school season in Australia, favorable foreign exchange rate impact on Canadian paper purchases and

profitability initiatives related to our own private label products.

Contract segment operating, selling and general and administrative expenses increased 1.0% of sales to

20.2% for 2010 from 19.2% of sales a year earlier. The increase was primarily due to costs associated with

growth and profitability initiatives associated with our managed-print-services, customer service centers and

business-to-business website, partially offset by favorable trends in workers compensation and medical benefit

expenses as well as lower payroll costs from the reorganization of our U.S. sales force and U.S. customer service

operations.

Contract segment income was $94.3 million, or 2.6% of sales, for 2010, compared to $58.0 million, or 1.6%

of sales, for 2009. The increase in segment income was primarily attributable to the increased gross profit margin

25