OfficeMax 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

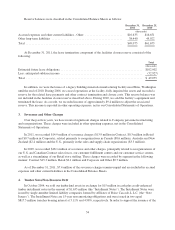

investment of $7.8 million in 2011, $7.3 million in 2010 and $6.7 million in 2009 in the Corporate and Other

segment. The dividend receivable was $38.0 million and $30.2 million at December 31, 2011 and December 25,

2010, respectively, and was recorded in the Corporate and Other segment in other non-current assets in the

Consolidated Balance Sheets.

The Company receives distributions on the Boise Investment for the income tax liability associated with its

share of allocated earnings. During 2009, the Company received a tax-related distribution of $2.6 million. No

distributions were received in 2011 or 2010.

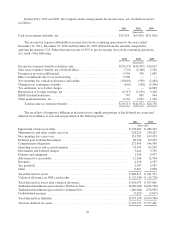

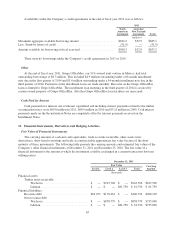

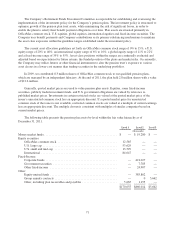

10. Debt

The Company’s debt, almost all of which is unsecured, consists of both recourse and non-recourse

obligations as follows at year-end:

2011 2010

(thousands)

Recourse debt:

7.35% debentures, due in 2016 ............................................ $ 17,967 $ 17,967

Medium-term notes, Series A, with interest rates averaging 7.9%, due in 2012 ...... 35,000 36,900

Revenue bonds, with interest rates averaging 6.4% , due in varying amounts

periodically through 2029 .............................................. 185,505 185,505

American & Foreign Power Company Inc. 5% debentures, due in 2030 ............ 18,526 18,526

Grupo OfficeMax installment loans, due in monthly installments through 2014 ...... 8,508 13,096

Other indebtedness, with interest rates averaging 6.8%, due in varying amounts

annually through 2016 ................................................. 3,188 3,536

$ 268,694 $ 275,530

Less unamortized discount ............................................... (504) (535)

Total recourse debt ................................................. $ 268,190 $ 274,995

Less current portion ..................................................... (38,867) (4,560)

Long-term debt, less current portion ................................ $ 229,323 $ 270,435

Non-recourse debt:

5.42% securitized timber notes, due in 2019 ................................. $ 735,000 $ 735,000

5.54% securitized timber notes, due in 2019 ................................. 735,000 735,000

Total non-recourse debt .......................................... $1,470,000 $1,470,000

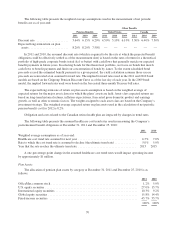

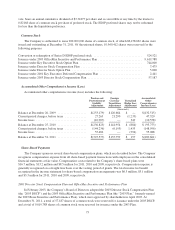

Scheduled Debt Maturities

The scheduled payments of recourse debt are as follows:

Total

(thousands)

2012 ............................................................................. $ 38,867

2013 ............................................................................. 3,858

2014 ............................................................................. 1,681

2015 ............................................................................. 105

2016 ............................................................................. 20,153

Thereafter ......................................................................... 204,030

Total ............................................................................. $268,694

63