OfficeMax 2011 Annual Report Download - page 55

Download and view the complete annual report

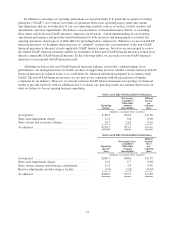

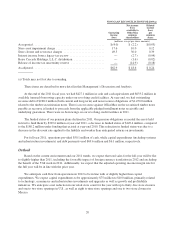

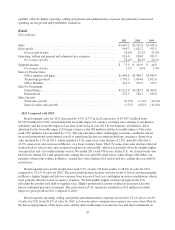

Please find page 55 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Canadian Contract sales forces, customer fulfillment centers and customer service centers, as well as a

streamlining of our Retail store staffing. These charges are recorded by segment in the following

manner: Contract $15.3 million, Retail $2.1 million and Corporate and Other $0.7 million. After tax

and noncontrolling interest, the cumulative effect of these items was a reduction of net income (loss)

available to OfficeMax common shareholders by $30.0 million, or $0.39 per diluted share.

• “Other income (expense), net” in the Consolidated Statement of Operations included income of

$2.6 million from a distribution on the Boise Investment related to our tax liability on allocated

earnings. This distribution was much larger in the prior year due to a significant tax gain realized by

Boise Cascade, L.L.C. on the sales of its paper and packaging and newsprint businesses. After tax, this

item increased net income (loss) available to OfficeMax common shareholders $1.6 million, or $0.02

per diluted share.

• We recorded $4.4 million of interest income related to a tax escrow balance established in a prior

period in connection with our legacy Voyager Panel business which we sold in 2004. After tax, this

item increased net income (loss) available to OfficeMax common shareholders by $2.7 million, or

$0.04 per diluted share.

• In the fourth quarter, the U.S. Internal Revenue Service conceded an issue under appeals regarding the

deductibility of interest on certain of our industrial revenue bonds. Upon the resolution of this matter,

we released $14.9 million in tax uncertainty reserves which increased net income (loss) available to

OfficeMax common shareholders by $0.18 per diluted share.

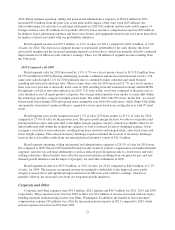

Interest income was $42.6 million and $47.3 million for 2010 and 2009, respectively. The decrease was due

primarily to $4.4 million of interest income recorded in 2009 related to a tax escrow balance established in a

prior period in connection with the sale of our legacy Voyageur Panel business. Interest expense decreased to

$73.3 million in 2010 from $76.4 million in 2009. The decrease in interest expense was due primarily to reduced

debt resulting from payments made in 2009 and 2010.

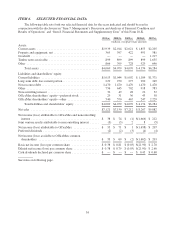

For 2010, we recognized income tax expense of $41.9 million on pre-tax income of $115.7 million

(effective tax expense rate of 36.2%) compared to income tax benefit of $28.8 million on a pre-tax loss of

$30.3 million (effective tax benefit rate of 94.8%) for 2009. The effective tax rate in both years was impacted by

the effects of state income taxes, income items not subject to tax, non-deductible expenses and the mix of

domestic and foreign sources of income as well as low levels of profitability in 2009. The effective tax rate in

2009 also included $14.9 million from the release of a tax reserve upon the resolution of our claim that interest

on certain of our industrial revenue bonds was fully tax deductible.

We reported net income attributable to OfficeMax and noncontrolling interest of $73.9 million for 2010.

After adjusting for joint venture earnings attributable to noncontrolling interest and preferred dividends, we

reported net income available to OfficeMax common shareholders of $68.6 million, or $0.79 per diluted share.

Adjusted net income available to OfficeMax common shareholders, as discussed above, was $77.3 million, or

$0.89 per diluted share, for 2010 compared to $18.6 million, or $0.24 per diluted share, for 2009.

Segment Discussion

We report our results using three reportable segments: Contract; Retail; and Corporate and Other.

Our Contract segment distributes a broad line of items for the office, including office supplies and paper,

technology products and solutions, office furniture and print and document services. Contract sells directly to

large corporate and government offices, as well as to small and medium-sized offices in the United States,

Canada, Australia and New Zealand. This segment markets and sells through field salespeople, outbound

telesales, catalogs, the Internet and in some markets, including Canada, Australia and New Zealand, through

office products stores.

23