OfficeMax 2011 Annual Report Download - page 54

Download and view the complete annual report

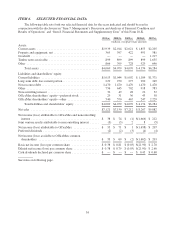

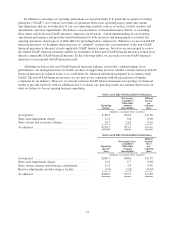

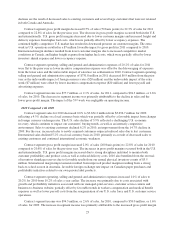

Please find page 54 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We reported net income attributable to OfficeMax and noncontrolling interest of $38.1 million for 2011.

After adjusting for joint venture earnings attributable to noncontrolling interest and preferred dividends, we

reported net income available to OfficeMax common shareholders of $32.8 million, or $0.38 per diluted share.

Adjusted net income available to OfficeMax common shareholders, as discussed above, was $53.3 million, or

$0.61 per diluted share, for 2011 compared to $77.3 million, or $0.89 per diluted share, for 2010.

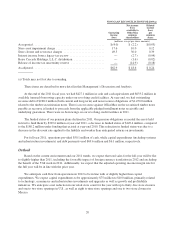

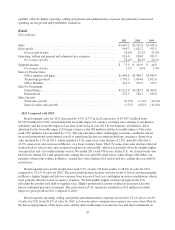

2010 Compared with 2009

Sales for 2010 decreased 0.9% to $7,150.0 million from $7,212.1 million for 2009, which included the

impact of favorable currency exchange rates relating to our international subsidiaries. On a local currency basis,

sales declined 2.9%. Both our Contract and Retail segments experienced year-over-year sales declines in a

challenging economic environment with increased competitive intensity including higher levels of promotional

activity.

Gross profit margin increased by 1.8% of sales (180 basis points) to 25.9% of sales in 2010 compared to 24.1%

of sales in 2009. The gross profit margins increased in both our Contract and Retail segments due to our profitability

initiatives and reduced inventory shrinkage expense. We benefited from $15 million of inventory shrinkage reserve

adjustments due to the positive results from our physical inventory counts. Retail segment gross profit margins also

benefitted from a sales mix shift to higher-margin products and lower occupancy and freight costs.

Operating, selling and general and administrative expenses increased 0.5% of sales to 23.7% of sales in

2010 from 23.2% of sales in 2009. The increase was in our Contract segment, as the Retail segment operating,

selling and general and administrative expenses as a percent of sales remained flat. The increase was the result of

higher expenses related to our growth and profitability initiatives which were partially offset by favorable trends

in workers compensation and medical benefit expenses, lower payroll-related expenses and favorable sales and

use tax and legal settlements in Retail. On a consolidated basis, we recognized $9 million of favorable sales/use

tax settlements and adjustments through the year as well as a $5 million gain related to the resolution of a legal

dispute. These items compare to approximately $10 million of income realized in the prior year related to

favorable property tax settlements and the resolution of a dispute with a service provider.

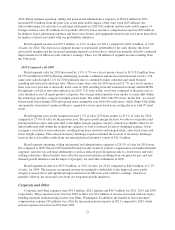

As noted above, our results for 2010 include several significant items, as follows:

• We recognized a non-cash impairment charge of $11.0 million associated with leasehold improvements

and other assets at certain of our Retail stores in the U.S. After tax, this charge reduced net income

available to OfficeMax common shareholders by $6.7 million, or $0.08 per diluted share.

• We recorded $13.1 million of charges in our Retail segment related to store closures in the U.S offset

by income of $0.6 million in our Retail segment to adjust previously established severance reserves.

After tax, the cumulative effect of these items was a reduction of net income available to OfficeMax

common shareholders of $7.8 million, or $0.09 per diluted share.

• We recorded income of $9.4 million related to the adjustment of a reserve associated with our legacy

building materials manufacturing facility near Elma, Washington due to the sale of the facility’s

equipment and the termination of the lease. This item increased net income available to OfficeMax

common shareholders by $5.8 million, or $0.07 per diluted share.

In addition, our results for 2009 include several significant items, as follows:

• We recognized a non-cash impairment charge of $17.6 million associated with leasehold improvements

and other assets at certain of our Retail stores in the U.S. and Mexico. After tax and noncontrolling

interest, these charges reduced net income (loss) available to OfficeMax common shareholders by

$10.0 million or $0.12 per diluted share.

• We recorded $31.2 million of charges in our Retail segment related to store closures. We also recorded

$18.1 million of severance and other charges, principally related to reorganizations of our U.S. and

22