OfficeMax 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15. Commitments and Guarantees

Commitments

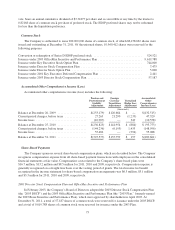

During the second quarter of 2011, we entered into a new paper supply contract with Boise White Paper,

L.L.C. (“Boise”), under which we have agreed to purchase office papers from Boise, and Boise has agreed to

supply office papers to us, subject to the terms and conditions of the paper supply contract. The new paper supply

contract replaced the previous supply contract executed in 2004 with Boise.

The paper supply contract requires us to purchase from Boise and Boise to sell to us virtually all of our

North American requirements for office paper, subject to certain conditions. After 2012, the paper supply

contract provides us more flexibility to purchase paper from paper producers other than Boise. The paper supply

contract’s term will expire on December 31, 2017, followed by a gradual reduction of the Company’s purchase

requirements over a two year period thereafter. However, if certain circumstances occur, the term may be

terminated earlier, beginning as early as December 31, 2012. If the term ends December 31, 2012, it will be

followed by a gradual reduction of the Company’s purchase requirements over a four year period. If the term

ends on a later date, the gradual reduction period will last two years. Purchases under the agreement were

$630.1 million, $615.6 million and $633.9 million for 2011, 2010 and 2009, respectively.

In accordance with an amended and restated joint venture agreement, the minority owner of Grupo

OfficeMax, our joint-venture in Mexico, can elect to require OfficeMax to purchase the minority owner’s 49%

interest in the joint venture if certain earnings targets are achieved. Earnings targets are calculated quarterly on a

rolling four-quarter basis. Accordingly, the targets may be achieved in one quarter but not in the next. If the

earnings targets are achieved and the minority owner elects to require OfficeMax to purchase the minority

owner’s interest, the purchase price is based on the joint venture’s earnings and the current market multiples of

similar companies. At the end of 2011, Grupo OfficeMax met the earnings targets and the estimated purchase

price of the minority owner’s interest was $27.6 million. This represents a decrease in the estimated purchase

price from the prior year which is attributable to lower market multiples for similar companies as of the

measurement date. As the estimated purchase price was less than the carrying value of the noncontrolling interest

as of the end of the year, the Company reduced the noncontrolling interest to the carrying value, with the offset

recorded to additional paid-in capital. There is no impairment relating to the assets of the joint venture as the

estimated future cash flows support the overall carrying value of its assets.

Guarantees

The Company provides guarantees, indemnifications and assurances to others.

Indemnification obligations may arise from the Asset Purchase Agreement between OfficeMax Incorporated,

OfficeMax Southern Company, Minidoka Paper Company, Forest Products Holdings, L.L.C. and Boise Land &

Timber Corp. The Company has agreed to provide indemnification with respect to a variety of obligations. These

indemnification obligations are subject, in some cases, to survival periods, deductibles and caps. At December 31,

2011, the Company is not aware of any material liabilities arising from these indemnifications.

There are six operating leases that have been assigned to other parties but for which the Company remains

contingently liable in the event of nonpayment by the other parties. The lease terms vary and, assuming exercise

of renewal options, extend through 2019. Annual rental payments under these leases are approximately

$3.0 million.

The Company and its affiliates enter into a wide range of indemnification arrangements in the ordinary

course of business. These include tort indemnifications, tax indemnifications, officer and director

indemnifications against third-party claims arising out of arrangements to provide services to the Company and

indemnifications in merger and acquisition agreements. It is impossible to quantify the maximum potential

liability under these indemnifications. At December 31, 2011, the Company is not aware of any material

liabilities arising from these indemnifications.

79