OfficeMax 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recently Issued or Newly Adopted Accounting Standards

In June 2011, the FASB issued guidance which establishes disclosure requirements for other comprehensive

income. The guidance requires the reporting of components of other comprehensive income and components of

net income together as components of total comprehensive income, and is effective for periods beginning on or

after December 15, 2011. The guidance requires retrospective application and earlier application is permitted.

The adoption of this guidance affects the presentation of certain elements of the Company’s financial statements,

but these changes in presentation will not have a material impact on our financial statements.

2. Facility Closure Reserves

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and close

those facilities that are no longer strategically or economically beneficial. We record a liability for the cost

associated with a facility closure at its fair value in the period in which the liability is incurred, primarily the

location’s cease-use date. Upon closure, unrecoverable costs are included in facility closure reserves and include

the present value of future lease obligations, less contractual or estimated sublease income. Accretion expense is

recognized over the life of the required payments.

During 2011, we recorded facility closure charges of $5.6 million in our Retail segment related to closing

six underperforming domestic stores prior to the end of their lease terms, of which $5.4 million was related to the

lease liability and $0.2 million was related to asset impairments.

During 2010, we recorded facility closure charges of $13.1 million in our Retail segment, of which $11.7

million was related to the lease liability and other costs associated with closing eight domestic stores prior to the

end of their lease terms, and $1.4 million was related to other items. In 2009, we recorded charges of

$31.2 million related to the closing of 21 underperforming stores prior to the end of their lease terms, of which 16

were in the U.S. and five were in Mexico.

These charges were included in other operating expenses, net in the Consolidated Statements of Operations.

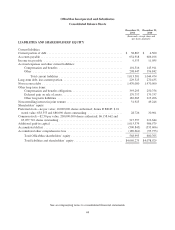

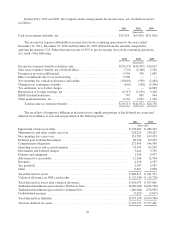

Facility closure reserve account activity during 2011, 2010 and 2009 was as follows:

Total

(thousands)

Balance at December 27, 2008 ......................................................... $48,933

Charges related to stores closed in 2009 ............................................. 31,208

Transfer of deferred rent balance ................................................... 3,214

Changes to estimated costs included in income ........................................ 9

Cash payments ................................................................. (24,594)

Accretion ..................................................................... 2,802

Balance at December 26, 2009 ......................................................... $61,572

Charges related to stores closed in 2010 ............................................. 13,069

Transfer of deferred rent and other balances .......................................... 5,985

Changes to estimated costs included in income ........................................ (1,358)

Cash payments ................................................................. (22,260)

Accretion ..................................................................... 4,665

Balance at December 25, 2010 ......................................................... $61,673

Charges related to stores closed in 2011 ............................................. 5,406

Transfer of deferred rent and other balances .......................................... 928

Changes to estimated costs included in income ........................................ 262

Cash payments ................................................................. (22,311)

Accretion ..................................................................... 3,117

Balance at December 31, 2011 ......................................................... $49,075

53