OfficeMax 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

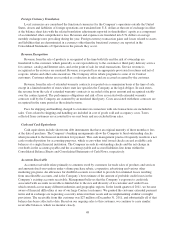

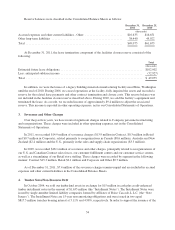

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Equity

For the fiscal years ended December 31, 2011, December 25, 2010 and December 26, 2009

Common

Shares

Outstanding

Preferred

Stock

Common

Stock

Additional

Paid-In

Capital

Retained

Earnings

(Accumulated

Deficit)

Accumulated

Other

Comprehensive

Income

(Loss)

Total

OfficeMax

Share-

holders’

Equity

Non-

controlling

Interest

(thousands, except per share)

75,977,152 Balance at December 27, 2008 ..... $42,565 $189,943 $ 925,328 $(600,095) $(267,738) $290,003 $ 21,871

Comprehensive income (loss):

Net income (loss) ............... — — — 667 — 667 (2,242)

Other comprehensive income:

Cumulative foreign currency

translation adjustment .......... 47,477 47,477 1,157

Pension and postretirement liability

adjustment, net of tax .......... 87,746 87,746 —

Other comprehensive income ...... 135,223 135,223 1,157

Comprehensive income (loss) ...... $135,890 $ (1,085)

Preferred stock dividend declared . . . — — — (2,818) — (2,818) —

313,517 Restricted stock unit activity ....... — 784 5,353 — — 6,137 —

8,331,722 Stock contribution to pension plan . . — 20,829 61,321 — — 82,150 —

2,335 Other ......................... (6,086) 6 (2,090) 4 — (8,166) 7,273

84,624,726 Balance at December 26, 2009 ..... $36,479 $211,562 $ 989,912 $(602,242) $(132,515) $503,196 $ 28,059

Comprehensive income:

Net income .................... — — — 71,155 — 71,155 2,709

Other comprehensive income:

Cumulative foreign currency

translation adjustment .......... 21,290 21,290 786

Pension and postretirement liability

adjustment, net of tax .......... 16,356 16,356 —

Unrealized hedge loss, net of tax . . . (884) (884) —

Other comprehensive income ...... 36,762 36,762 786

Comprehensive income ........... $107,917 $ 3,495

Preferred stock dividend declared . . . — — — (2,527) (2,527) —

950 Restricted stock unit activity ....... — — 7,972 — — 7,972 —

Non-controlling interest fair value

adjustment ................... — — (17,763) — — (17,763) 17,763

408,519 Stock options exercised ........... — 1,021 940 — — 1,961 —

23,515 Other ......................... (5,578) 61 5,518 8 — 9 (71)

85,057,710 Balance at December 25, 2010 ..... $30,901 $212,644 $ 986,579 $(533,606) $ (95,753) $600,765 $ 49,246

Comprehensive income:

Net income .................... — — — 34,894 — 34,894 3,226

Other comprehensive income:

Cumulative foreign currency

translation adjustment .......... (6,195) (6,195) (2,754)

Pension and postretirement liability

adjustment, net of tax .......... (88,754) (88,754) —

Unrealized hedge loss, net of tax . . . 1,041 1,041 —

Other comprehensive loss ......... (93,908) (93,908) (2,754)

Comprehensive income (loss) ...... $(59,014) $ 472

Preferred stock dividend declared . . . — — — (2,123) — (2,123) —

685,373 Restricted stock unit activity ....... — 1,711 3,908 — — 5,619 —

Non-controlling interest fair value

adjustment ................... — — 17,763 — — 17,763 (17,763)

405,988 Stock options exercised ........... — 1,015 934 — — 1,949 —

9,591 Other ......................... (2,175) 27 6,190 (8) — 4,034 (32)

86,158,662 Balance at December 31, 2011 ..... $28,726 $215,397 $1,015,374 $(500,843) $(189,661) $568,993 $ 31,923

See accompanying notes to consolidated financial statements

46