OfficeMax 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Retail segment is a retail distributor of office supplies and paper, print and document services,

technology products and solutions and office furniture. In addition, this segment contracts with large national

retail chains to supply office and school supplies to be sold in their stores. Our retail office supply stores feature

OfficeMax ImPress, an in-store module devoted to print-for-pay and related services. Retail has operations in the

United States, Puerto Rico and the U.S. Virgin Islands. Retail also operates office products stores in Mexico

through a 51%-owned joint venture.

Our Corporate and Other segment includes support staff services and certain other legacy expenses as well

as the related assets and liabilities. The income and expense related to certain assets and liabilities that are

reported in the Corporate and Other segment have been allocated to the Contract and Retail segments.

Management evaluates the segments’ performances using segment income (loss) which is based on

operating income (loss) after eliminating the effect of certain operating items that are not indicative of our core

operations such as severances, facility closures and adjustments, and asset impairments. These certain operating

items are reported on the asset impairments and the other operating expenses lines in the Consolidated

Statements of Operations.

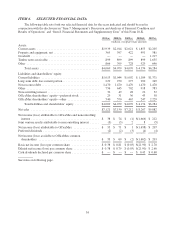

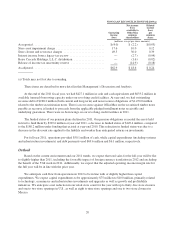

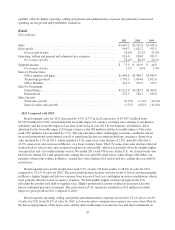

Contract

($ in millions)

2011 2010 2009

Sales ........................................................ $3,624.1 $3,634.2 $3,656.7

Gross profit ................................................... 809.5 827.0 762.4

Gross profit margin ......................................... 22.3% 22.8% 20.8%

Operating, selling and general and administrative expenses ............. 731.8 732.7 704.4

Percentage of sales ......................................... 20.2% 20.2% 19.2%

Segment income ............................................... $ 77.7 $ 94.3 $ 58.0

Percentage of sales ......................................... 2.1% 2.6% 1.6%

Sales by Product Line

Office supplies and paper .................................... $2,076.0 $2,086.6 $2,138.5

Technology products ........................................ 1,142.2 1,185.5 1,174.0

Office furniture ............................................ 405.9 362.1 344.2

Sales by Geography

United States .............................................. $2,449.3 $2,482.5 $2,583.1

International .............................................. 1,174.8 1,151.7 1,073.6

Sales Growth .................................................. (0.3)% (0.6)% (15.2)%

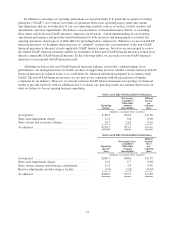

2011 Compared with 2010

Contract segment sales for 2011 decreased 0.3% (2.6% in local currencies) to $3,624.1 million from

$3,634.2 million for 2010, and included the favorable impact of currency exchange rates relating to our

international subsidiaries and the favorable impact of an extra week in fiscal year 2011 in our domestic

subsidiaries. After adjusting for the favorable impact of foreign currency rates ($84 million) and the favorable

impact of the extra week ($35 million), sales declined by 3.5%. U.S. Contract sales for 2011 declined 1.3%

compared to 2010 (2.7% after adjusting for the impact of the extra week) due to a continued, highly competitive

environment in the U.S. A decline in sales to existing customers, including a significant decrease in sales to the

U.S. federal government, was partially offset by increased favorable impact of sales to newly acquired customers

outpacing the reduction in sales due to lost customers. Fourth quarter of 2011 results trended favorably as the

decline in sales to existing customers for the fourth quarter was lower than that for the third quarter and sales to

newly acquired customers outpaced the reduction in sales due to lost customers. U.S. Contract sales trended

positive by 0.2 % for the fourteen week period ended December 31, 2011 compared to the same fourteen week

period in 2010. International sales for 2011 increased 2.0%, but declined 5.3% on a local currency basis. The

24