Nordstrom 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 59

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

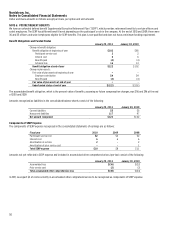

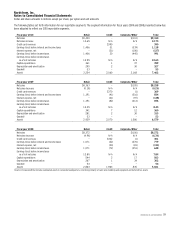

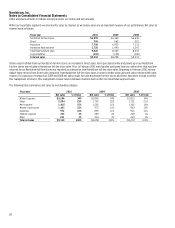

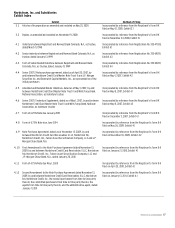

The following tables set forth information for our reportable segments. The segment information for fiscal years 2009 and 2008 presented below has

been adjusted to reflect our 2010 reportable segments.

Fiscal year 2010 Retail Credit Corporate/Other Total

Net sales $9,420 — $(110) $9,310

Net sales increase 12.6% N/A N/A 12.7%

Credit card revenues — $390 — 390

Earnings (loss) before interest and income taxes 1,406 51 (339) 1,118

Interest expense, net — (21) (106) (127)

Earnings (loss) before income taxes 1,406 30 (445) 991

Earnings (loss) before income taxes

as a % of net sales 14.9% N/A N/A 10.6%

Capital expenditures 361 1 37 399

Depreciation and amortization 295 2 30 327

Goodwill 53 — — 53

Assets1 3,234 2,060 2,168 7,462

Fiscal year 2009 Retail Credit Corporate/Other Total

Net sales $8,363 — $(105) $8,258

Net sales decrease (0.1%) N/A N/A (0.2%)

Credit card revenues — $370 (1) 369

Earnings (loss) before interest and income taxes 1,191 (41) (316) 834

Interest expense, net — (41) (97) (138)

Earnings (loss) before income taxes 1,191 (82) (413) 696

Earnings (loss) before income taxes

as a % of net sales 14.2% N/A N/A 8.4%

Capital expenditures 341 7 12 360

Depreciation and amortization 281 2 30 313

Goodwill 53 — — 53

Assets1 2,929 2,070 1,580 6,579

Fiscal year 2008 Retail Credit Corporate/Other Total

Net sales $8,372 — $(100) $8,272

Net sales decrease (4.9%) N/A N/A (6.3%)

Credit card revenues — $302 (1) 301

Earnings (loss) before interest and income taxes 1,071 (22) (270) 779

Interest expense, net — (50) (81) (131)

Earnings (loss) before income taxes 1,071 (72) (351) 648

Earnings (loss) before income taxes

as a % of net sales 12.8% N/A N/A 7.8%

Capital expenditures 544 2 17 563

Depreciation and amortization 267 1 34 302

Goodwill 53 — — 53

Assets1 2,863 1,963 835 5,661

1Assets in Corporate/Other include unallocated assets in corporate headquarters, consisting primarily of cash, land, buildings and equipment and deferred tax assets.