Nordstrom 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

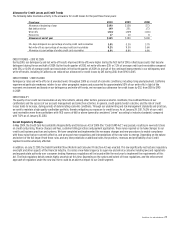

Adjusted Debt to EBITDAR (Non-GAAP financial measure)

We define Adjusted Debt to EBITDAR as follows:

Adjusted Debt to EBITDAR = Adjusted Debt

EBITDAR

Adjusted Debt to EBITDAR is one of our key financial metrics, and we believe that our debt levels are best analyzed using this measure. Our current goal

is to manage debt levels to maintain an investment-grade credit rating as well as operate with an efficient capital structure for our size, growth plans

and industry. Investment-grade credit ratings are important to maintaining access to a variety of short-term and long-term sources of funding, and we

rely on these funding sources to continue to grow our business. We believe a higher ratio, among other factors, could result in rating agency

downgrades. In contrast, we believe a lower ratio would result in a higher cost of capital and could negatively impact shareholder returns. As of

January 29, 2011, our Adjusted Debt to EBITDAR was 2.2 compared with 2.5 as of January 30, 2010. The decrease was primarily the result of an increase

in earnings before interest and income taxes in 2010 compared with 2009.

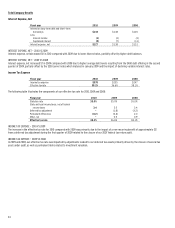

Adjusted Debt to EBITDAR is not a measure of financial performance under GAAP and should not be considered a substitute for debt to net earnings,

net earnings or debt as determined in accordance with GAAP. In addition, Adjusted Debt to EBITDAR does have limitations:

Adjusted Debt is not exact, but rather our best estimate of the total company debt we would hold if we had purchased the property and

issued debt associated with our operating leases;

EBITDAR does not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments, including

leases, or the cash requirements necessary to service interest or principal payments on our debt; and

Other companies in our industry may calculate Adjusted Debt to EBITDAR differently than we do, limiting its usefulness as a

comparative measure.

To compensate for these limitations, we analyze Adjusted Debt to EBITDAR in conjunction with other GAAP financial and performance measures

impacting liquidity, including operating cash flows, capital spending and net earnings. The closest measure calculated using GAAP amounts is debt to

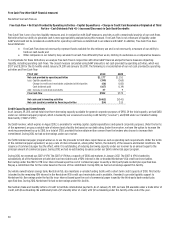

net earnings, which was 4.5 and 5.9 for 2010 and 2009. The following is a comparison of debt to net earnings and Adjusted Debt to EBITDAR:

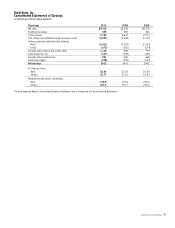

20101 20091

Debt $2,781 $2,613

Add: rent expense x 82 500 341

Less: fair value of interest rate swaps included in long-term debt (25) —

Adjusted Debt $3,256 $2,954

Net earnings 613 441

Add: income tax expense 378 255

Add: interest expense, net 127 138

Earnings before interest and income taxes 1,118 834

Add: depreciation and amortization of buildings and equipment, net 327 313

Add: rent expense 62 43

EBITDAR $1,507 $1,190

Debt to Net Earnings 4.5 5.9

Adjusted Debt to EBITDAR 2.2 2.5

1The components of adjusted debt are as of the end of 2010 and 2009, while the components of EBITDAR are for the 12 months ended January 29, 2011 and January 30, 2010.

2The multiple of eight times rent expense used to calculate adjusted debt is a commonly used method of estimating the debt we would record for our leases that are classified as operating if

they had met the criteria for a capital lease, or we had purchased the property.