Nordstrom 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

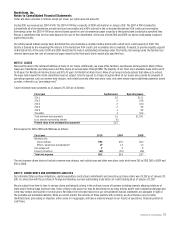

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market, using the retail method (weighted average cost).

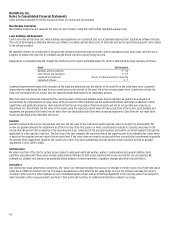

Land, Buildings and Equipment

Land is recorded at historical cost, while buildings and equipment are recorded at cost less accumulated depreciation. Capitalized software includes

the costs of developing or obtaining internal-use software, including external direct costs of materials and services and internal payroll costs related

to the software project.

We capitalize interest on construction in progress and software projects during the period in which expenditures have been made, activities are in

progress to prepare the asset for its intended use and actual interest costs are being incurred.

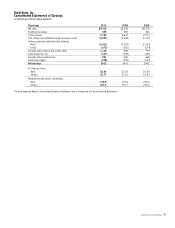

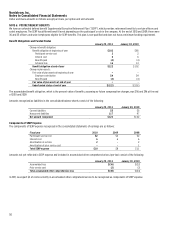

Depreciation is computed using the straight-line method over the asset’s estimated useful life, which is determined by asset category as follows:

Asset Life (in years)

Buildings and improvements 5 – 40

Store fixtures and equipment 3 – 15

Leasehold improvements Shorter of initial lease term or asset life

Capitalized software 3 – 7

Leasehold improvements made at the inception of the lease are amortized over the shorter of the asset life or the initial lease term. Leasehold

improvements made during the lease term are amortized over the shorter of the asset life or the remaining lease term. Lease terms include the

fixed, non-cancelable term of a lease, plus any renewal periods determined to be reasonably assured.

When facts and circumstances indicate that the carrying values of long-lived tangible assets may be impaired, we perform an evaluation of

recoverability by comparing the carrying values of the net assets to their related projected undiscounted future cash flows in addition to other

quantitative and qualitative analyses. Upon indication that the carrying values of long-lived assets will not be recoverable, we recognize an

impairment loss. We estimate the fair value of the assets using the expected present value of future cash flows of the assets. Land, building and

equipment are grouped at the lowest level at which there are identifiable cash flows when assessing impairment. Cash flows for our retail store

assets are identified at the individual store level.

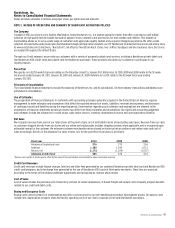

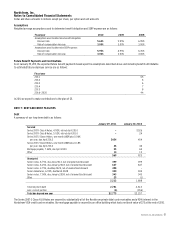

Goodwill

Goodwill represents the excess of acquisition cost over the fair value of the related net assets acquired, and is not subject to amortization. We

review our goodwill annually for impairment as of the first day of the first quarter or when circumstances indicate its carrying value may not be

recoverable. We perform this evaluation at the reporting unit level, comprised of the principal business units within our Retail segment, through the

application of a two-step fair value test. The first step of the test compares the carrying value of the reporting unit to its estimated fair value, which

is based on the expected present value of future cash flows. If fair value does not exceed carrying value then a second step is performed to quantify

the amount of the impairment. Based on the results of our tests, fair value substantially exceeds carrying value, therefore we had no goodwill

impairment in 2010, 2009 or 2008.

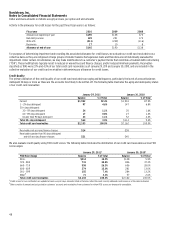

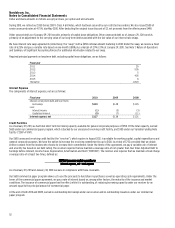

Self Insurance

We retain a portion of the risk for certain losses related to employee health and welfare, workers’ compensation and general liability claims.

Liabilities associated with these losses include undiscounted estimates of both losses reported and losses incurred but not yet reported. We

estimate our ultimate cost based on an actuarially based analysis of claims experience, regulatory changes and other relevant factors.

Derivatives

Our interest rate swap agreements (collectively, the “swap”) are intended to hedge the exposure of changes in the fair value of our fixed-rate senior

notes due in 2018 from interest rate risk. The swap is designated as a fully effective fair value hedge. As such, the interest rate swap fair value is

included in other assets or other liabilities on our consolidated balance sheet, with an offsetting adjustment to the carrying value of our long-term

debt (included in other unsecured debt). See Note 7: Debt and Credit Facilities for additional information related to our swap.