Nordstrom 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 23

Allowance for Credit Losses and Credit Trends

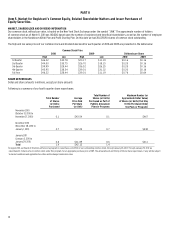

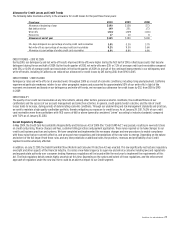

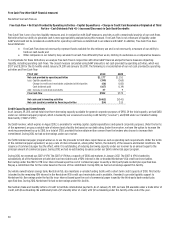

The following table illustrates activity in the allowance for credit losses for the past three fiscal years:

Fiscal year 2010 2009 2008

Allowance at beginning of year $190 $138 $73

Bad debt provision 149 251 173

Write–offs (211) (209) (116)

Recoveries 17 10 8

Allowance at end of year $145 $190 $138

30+ days delinquent as a percentage of ending credit card receivables 3.0% 5.3% 3.7%

Net write-offs as a percentage of average credit card receivables 9.2% 9.5% 5.6%

Allowance as a percentage of ending credit card receivables 6.9% 8.8% 6.8%

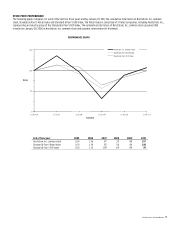

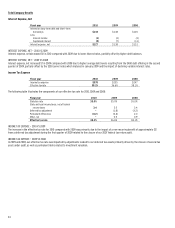

CREDIT TRENDS — 2010 VS 2009

During 2010, our delinquency and net write-off results improved. Write-offs were higher during the first half of 2010, reflecting accounts that became

delinquent during the second half of 2009. By the fourth quarter of 2010, net write-offs were $39, or 7.2% of average credit card receivables compared

with $56, or 10.5% of average credit card receivables in the fourth quarter of 2009. As a result of the continued improvements in our delinquency and

write-off results, including in California, we reduced our allowance for credit losses by $45 during 2010, from $190 to $145.

CREDIT TRENDS — 2009 VS 2008

Delinquency rates and write-offs ran at elevated levels throughout 2009 as a result of economic conditions, including rising unemployment. California

experienced particular weakness relative to our other geographic regions and accounted for approximately 50% of our write-offs. In light of the

economic environment and based on our delinquency and write-off trends, we increased our allowance for credit losses by $52, from $138 to $190

in 2009.

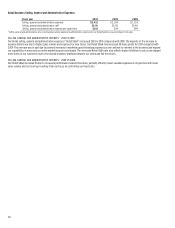

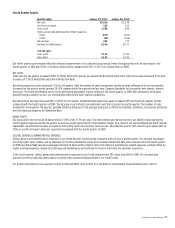

CREDIT QUALITY

The quality of our credit card receivables at any time reflects, among other factors, general economic conditions, the creditworthiness of our

cardholders and the success of our account management and collection activities. In general, credit quality tends to decline, and the risk of credit

losses tends to increase, during periods of deteriorating economic conditions. Through our underwriting and risk management standards and practices,

we seek to maintain a high quality cardholder portfolio, thereby mitigating our exposure to credit losses. As of January 29, 2011, 76.2% of our credit

card receivables were from cardholders with FICO scores of 660 or above (generally considered “prime” according to industry standards) compared

with 71.2% as of January 30, 2010.

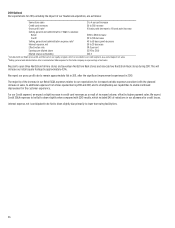

Recent Regulatory Changes

In May 2009, the Credit Card Accountability Responsibility and Disclosure Act of 2009 (the “Credit CARD Act”) was passed, resulting in new restrictions

on credit card pricing, finance charges and fees, customer billing practices and payment application. These rules required us to make changes to our

credit card business practices and systems. We have completed and implemented the necessary changes and new procedures to enable compliance

with those rules that are currently effective, and we expect more regulations and interpretations of the new rules to emerge. Depending on the nature

and extent of the full impact from these rules, and any interpretations or additional rules, the practices, revenues and profitability of our Credit

segment could be adversely affected.

In addition, on July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted. This law significantly restructures regulatory

oversight and other aspects of the financial industry. It creates a new federal agency to supervise and enforce consumer lending laws and regulations

and expands state authority over consumer lending. Numerous regulations will be issued within the next year to implement the requirements of this

Act. The final regulatory details remain highly uncertain at this time. Depending on the nature and extent of these regulations, and the enforcement

approach of regulators under the new law, there could be an adverse impact to our Credit segment.