Nordstrom 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 47

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

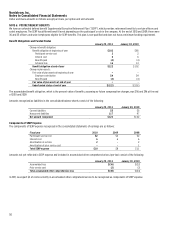

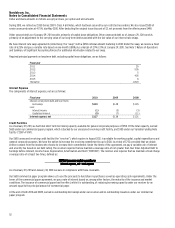

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable approximate fair value due to their short-term

nature.

The estimated fair value of long-term debt, including current maturities and excluding the value of our interest rate swap, was $3,010 and $2,810 at

the end of 2010 and 2009, compared with carrying values of $2,757 and $2,613. The estimated fair value of the swap was a $25 asset and a $1 liability

at the end of 2010 and 2009. The fair value of long-term debt is estimated using quoted market prices of the same or similar issues, while the fair

value of our swap is estimated based upon observable market-based inputs for identical or comparable arrangements from reputable third-party

brokers, adjusted for credit risk. As such, these are considered Level 2 measurements, as defined by applicable fair value accounting standards.

Recent Accounting Pronouncements

In July 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2010-20,

Disclosures about the

Credit Quality of Financing Receivables and the Allowance for Credit Losses

, which was subsequently modified by ASU No. 2011-01,

Deferral of the

Effective Date of Disclosures about Troubled Debt Restructurings in Update No. 2010-20

. The provisions of this ASU (as modified), which are effective

beginning with this annual report for the year ended January 29, 2011, did not impact our consolidated financial position or statement of operations,

as its requirements are disclosure-only in nature.

In December 2010, the FASB Emerging Issues Task Force (“EITF”) issued ASU No. 2010-28,

When to Perform Step 2 of the Goodwill Impairment Test for

Reporting Units with Zero or Negative Carrying Amounts

. ASU No. 2010-28 modifies Step 1 of the goodwill impairment test for reporting units with

zero or negative carrying amounts to require Step 2 of the goodwill impairment test to be performed if it is more likely than not that goodwill

impairment exists. We do not expect the provisions of this ASU, which are effective for us as of the beginning of 2011, to have a material impact on

our consolidated financial statements.

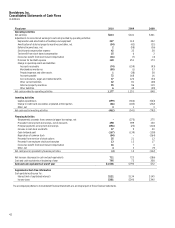

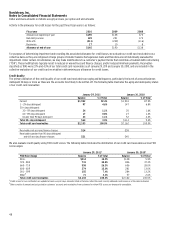

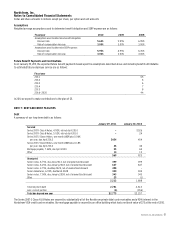

NOTE 2: ACCOUNTS RECEIVABLE

The components of accounts receivable are as follows:

January 29, 2011 January 30, 2010

Credit card receivables:

Nordstrom VISA credit card receivables $1,431 $1,477

Nordstrom private label card receivables 672 685

Total credit card receivables 2,103 2,162

Allowance for credit losses (145) (190)

Credit card receivables, net 1,958 1,972

Other accounts receivable 68 63

Accounts receivable, net $2,026 $2,035

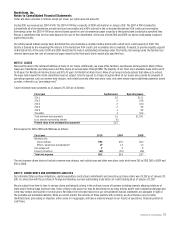

As of January 29, 2011 and January 30, 2010, $2,061 and $2,136 of our credit card receivables are restricted under our securitization program. On a

daily basis, 100% of the restricted Nordstrom private label credit card receivables and 90% of the restricted Nordstrom VISA credit card receivables

are transferred to a third-party trust to secure the Series 2007-2 Notes and our 2007-A variable funding note. In addition, these restricted

receivables secured our Series 2007-1 Notes, which were retired in April 2010. The remaining 10% of the restricted Nordstrom VISA credit card

receivables are retained by our wholly owned federal savings bank, Nordstrom fsb, to secure their variable funding facility. As of January 29, 2011

and January 30, 2010, a portion of our restricted receivables were unencumbered by outstanding borrowings and credit facilities. Our credit card

securitization agreements set a maximum percentage of receivables that can be associated with various receivable categories, such as employee or

foreign receivables. As of January 29, 2011 and January 30, 2010, these maximums were not exceeded.

Other accounts receivable consist primarily of credit and debit card receivables due from third-party financial institutions and vendor claims.