Nordstrom 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 51

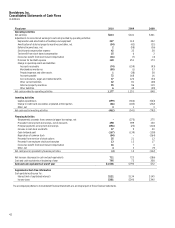

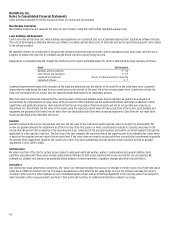

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

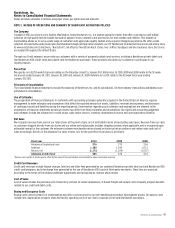

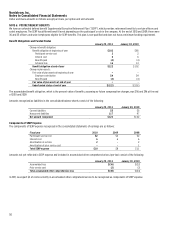

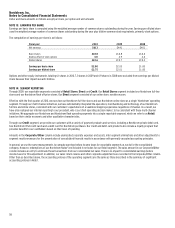

Assumptions

Weighted average assumptions used to determine benefit obligation and SERP expense are as follows:

Fiscal year 2010 2009 2008

Assumptions used to determine benefit obligation:

Discount rate 5.60% 5.95% 6.95%

Rate of compensation increase 3.00% 3.00% 3.00%

Assumptions used to determine SERP expense:

Discount rate 5.95% 6.95% 6.35%

Rate of compensation increase 3.00% 3.00% 3.00%

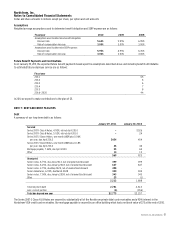

Future Benefit Payments and Contributions

As of January 29, 2011, the expected future benefit payments based upon the assumptions described above and including benefits attributable

to estimated future employee service are as follows:

Fiscal year

2011 $5

2012 6

2013 6

2014 7

2015 8

2016-2020 44

In 2011, we expect to make contributions to the plan of $5.

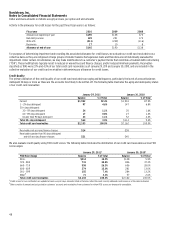

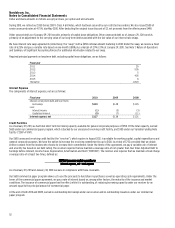

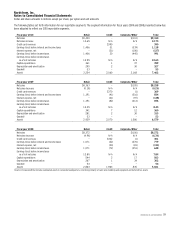

NOTE 7: DEBT AND CREDIT FACILITIES

Debt

A summary of our long-term debt is as follows:

January 29, 2011 January 30, 2010

Secured

Series 2007-1 Class A Notes, 4.92%, retired April 2010 - $326

Series 2007-1 Class B Notes, 5.02%, retired April 2010 - 24

Series 2007-2 Class A Notes, one-month LIBOR plus 0.06%

per year, due April 2012 $454 454

Series 2007-2 Class B Notes, one-month LIBOR plus 0.18%

per year, due April 2012 46 46

Mortgage payable, 7.68%, due April 2020 55 60

Other 14 15

569 925

Unsecured

Senior notes, 6.75%, due June 2014, net of unamortized discount 399 399

Senior notes, 6.25%, due January 2018, net of unamortized discount 647 647

Senior notes, 4.75%, due May 2020, net of unamortized discount 498 -

Senior debentures, 6.95%, due March 2028 300 300

Senior notes, 7.00%, due January 2038, net of unamortized discount 343 343

Other 25 (1)

2,212 1,688

Total long-term debt 2,781 2,613

Less: current portion (6) (356)

Total due beyond one year $2,775 $2,257

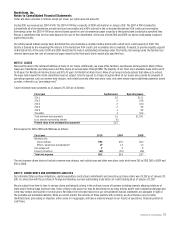

The Series 2007-2 Class A & B Notes are secured by substantially all of the Nordstrom private label card receivables and a 90% interest in the

Nordstrom VISA credit card receivables. Our mortgage payable is secured by an office building which had a net book value of $75 at the end of 2010.