Nordstrom 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 53

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

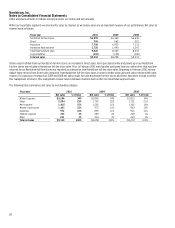

During 2010, we renewed our 2007-A VFN. The 2007-A VFN has a capacity of $300 and matures in January 2012. The 2007-A VFN is backed by

substantially all of the Nordstrom private label card receivables and a 90% interest in the co-branded Nordstrom VISA credit card receivables.

Borrowings under the 2007-A VFN incur interest based upon the cost of commercial paper issued by a third-party bank conduit plus specified fees.

We pay a commitment fee for the notes based on the size of the commitment. At the end of both 2010 and 2009, we had no outstanding issuances

against this facility.

Our wholly owned federal savings bank, Nordstrom fsb, also maintains a variable funding facility with a short-term credit capacity of $100. This

facility is backed by the remaining 10% interest in the Nordstrom VISA credit card receivables and is available, if needed, to provide liquidity support

to Nordstrom fsb. At the end of 2010 and 2009, Nordstrom fsb had no outstanding borrowings under this facility. Borrowings under the facility incur

interest based upon the cost of commercial paper issued by the third-party bank conduit plus specified fees.

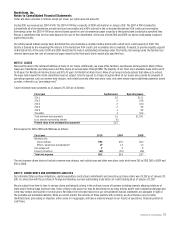

NOTE 8: LEASES

We lease the land or the land and buildings at many of our stores. Additionally, we lease office facilities, warehouses and equipment. Most of these

leases are classified as operating leases and they expire at various dates through 2080. The majority of our fixed, non-cancelable lease terms are 15

to 30 years for Nordstrom full-line stores and 10 to 15 years for Nordstrom Rack stores. Many of our leases include options that allow us to extend

the lease term beyond the initial commitment period, subject to terms agreed to at lease inception. Most of our leases also provide for payment of

operating expenses, such as common area charges, real estate taxes and other executory costs, and some leases require additional payments based

on sales, referred to as “percentage rent.”

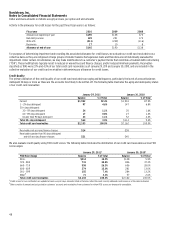

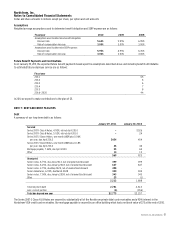

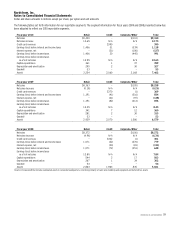

Future minimum lease payments as of January 29, 2011 are as follows:

Fiscal year Capital leases Operating leases

2011 $2 $111

2012 2 108

2013 2 100

2014 2 96

2015 3 92

Thereafter 4 524

Total minimum lease payments 15 $1,031

Less: amount representing interest (5)

Present value of net minimum lease payments $10

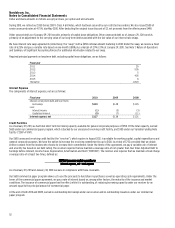

Rent expense for 2010, 2009 and 2008 was as follows:

Fiscal year 2010 2009 2008

Minimum rent:

Store locations $94 $76 $63

Offices, warehouses and equipment 19 13 13

Percentage rent 9 9 9

Property incentives (60) (55) (48)

Total rent expense $62 $43 $37

The rent expense above does not include common area charges, real estate taxes and other executory costs which were $65 in 2010, $60 in 2009 and

$56 in 2008.

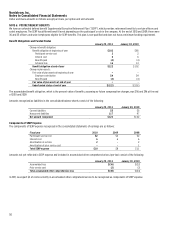

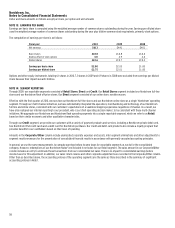

NOTE 9: COMMITMENTS AND CONTINGENT LIABILITIES

Our estimated total purchase obligations, capital expenditure contractual commitments and inventory purchase orders were $1,302 as of January 29,

2011. In connection with the purchase of foreign merchandise, we have outstanding trade letters of credit totaling $6 as of January 29, 2011.

We are subject from time to time to various claims and lawsuits arising in the ordinary course of business including lawsuits alleging violations of

state and/or federal wage and hour laws. Some of these suits purport or may be determined to be class actions and/or seek substantial damages and

some may remain unresolved for several years. We believe the recorded reserves in our consolidated financial statements are adequate in light of

the probable and estimable liabilities. While we cannot predict the outcome of these matters with certainty, we do not believe any currently

identified claim, proceeding or litigation, either alone or in aggregate, will have a material impact on our results of operations, financial position or

cash flows.