Nordstrom 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

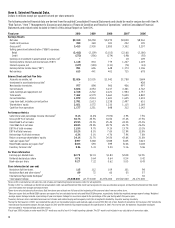

2011 Outlook

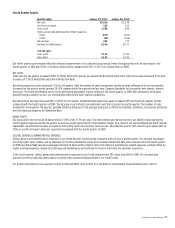

Our expectations for 2011, excluding the impact of our HauteLook acquisition, are as follows:

Same-store sales 2 to 4 percent increase

Credit card revenues $0 to $10 increase

Gross profit rate1 10 basis point decrease to 10 basis point increase

Selling, general and administrative (“SG&A”) expenses:

Retail $120 to $160 increase

Credit $0 to $10 decrease

Selling, general and administrative expense rate2 45 to 65 basis point decrease

Interest expense, net $0 to $5 decrease

Effective tax rate 39.0 percent

Earnings per diluted share $2.95 to $3.10

Diluted shares outstanding 223.3

1Includes both our Retail gross profit and the cost of our loyalty program, which is recorded in our Credit segment, as a percentage of net sales.

2Selling, general and administrative rate is calculated as SG&A expense for the total company as a percentage of net sales.

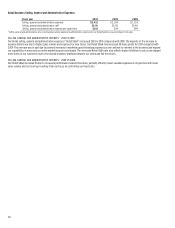

We plan to open three Nordstrom full-line stores and seventeen Nordstrom Rack stores and relocate two Nordstrom Rack stores during 2011. This will

increase our retail square footage by approximately 4.3%.

We expect our gross profit rate to remain approximately flat in 2011, after the significant improvement experienced in 2010.

The majority of the increase in our Retail SG&A expenses relates to our expectations for increased variable expenses consistent with the planned

increase in sales, to additional expenses from stores opened during 2010 and 2011, and to strengthening our capabilities to enable continued

improvement in the customer experience.

For our Credit segment, we expect a slight increase in credit card revenues as a result of increased volume, offset by higher payment rates. We expect

Credit SG&A expenses to be flat to down slightly when compared with 2010 results, which included $45 of reductions in our allowance for credit losses.

Interest expense, net is anticipated to be flat to down slightly due primarily to lower borrowing facility fees.