Nordstrom 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 49

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

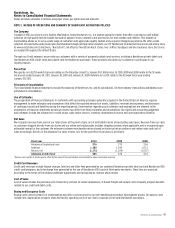

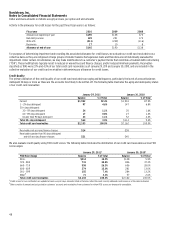

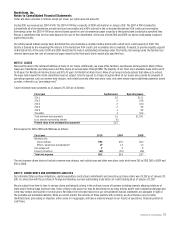

NOTE 3: LAND, BUILDINGS AND EQUIPMENT

Land, buildings and equipment consist of the following:

January 29, 2011 January 30, 2010

Land and land improvements $72 $70

Buildings and building improvements 919 924

Leasehold improvements 1,914 1,735

Store fixtures and equipment 2,341 2,267

Capitalized software 404 382

Construction in progress 188 180

5,838 5,558

Less: accumulated depreciation and amortization (3,520) (3,316)

Land, buildings and equipment, net $2,318 $2,242

The total cost of buildings and equipment held under capital lease obligations was $28 at the end of both 2010 and 2009, with related accumulated

amortization of $23 in 2010 and $22 in 2009. The amortization of capitalized leased buildings and equipment of $1 in both 2010 and 2009 was

recorded in depreciation expense.

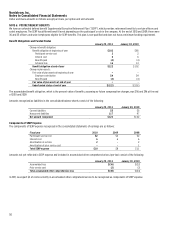

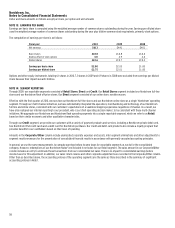

NOTE 4: SELF INSURANCE

Our self insurance reserves are summarized as follows:

January 29, 2011 January 30, 2010

Workers’ compensation $50 $50

Employee health and welfare 18 20

General liability 11 10

Total $79 $80

Our workers’ compensation policies have a retention per claim of $1 or less and no policy limits.

We are self-insured for the majority of our employee health and welfare coverage, and we do not use stop-loss coverage. Participants contribute

to the cost of their coverage through both premiums and out-of-pocket expenses and are subject to certain plan limits and deductibles.

Our general liability policies, encompassing employment practices liability and commercial general liability, have a retention per claim of $1 or less

and a policy limit up to $25 and $150, respectively.

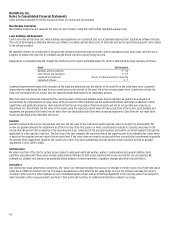

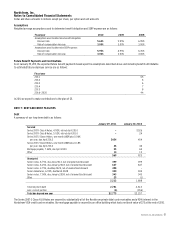

NOTE 5: 401(k) AND PROFIT SHARING

We provide a 401(k) and profit sharing plan for our employees. Our Board of Directors establishes our profit sharing contribution each year.

The 401(k) component is funded by voluntary employee contributions. In February 2009, the plan was amended to replace our fixed company

matching contribution with a discretionary contribution in an amount determined by our Board of Directors. Our expense related to the profit

sharing component and the matching contributions of the 401(k) component totaled $86, $74 and $39 in 2010, 2009 and 2008.