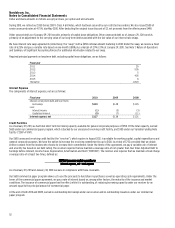

Nordstrom 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 57

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share, per option and unit amounts

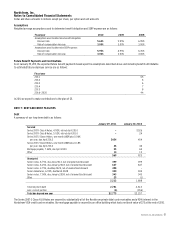

In 2009 and 2008, the IRS completed its routine examination of our federal filings for the 2007 and 2002 through 2006 years, respectively.

As a result of adjustments identified in the IRS examinations and revisions of estimates, we increased our deferred tax assets, which resulted

in a reduction in our effective tax rate in 2009 and 2008.

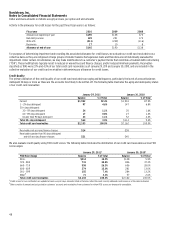

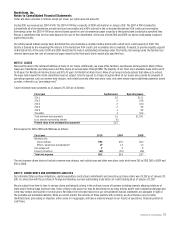

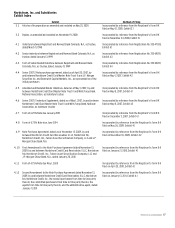

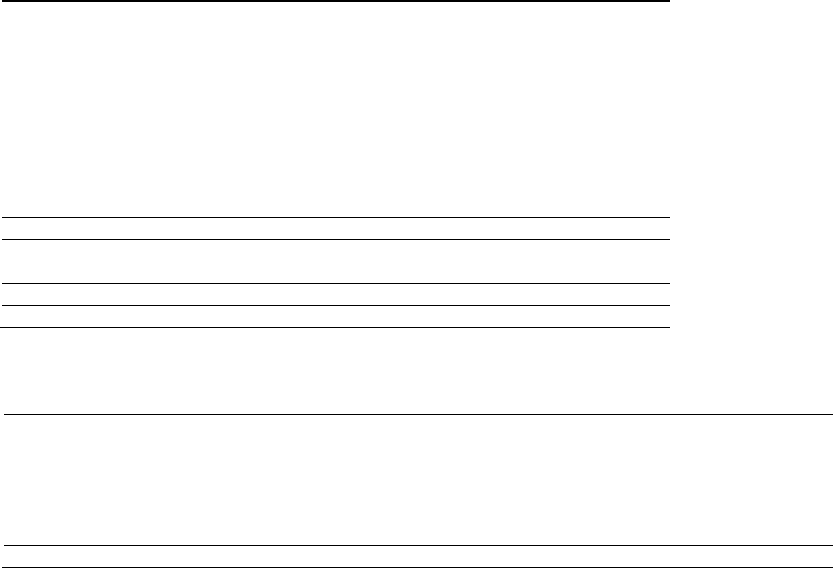

The major components of deferred tax assets and liabilities are as follows:

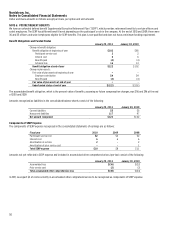

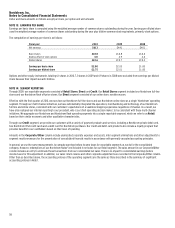

A reconciliation of the beginning and ending amount of unrecognized tax benefits for 2010, 2009 and 2008 is as follows:

At the end of 2010, 2009 and 2008, $22, $25 and $10 of the ending gross unrecognized tax benefit balance relates to deferred items which,

if recognized, would not impact the effective tax rate.

Our income tax expense included $5 in 2010 and $2 in each of 2009 and 2008 of tax-related interest and penalties. At the end of 2010, 2009 and 2008,

our liability for interest and penalties was $11, $7 and $6.

We file income tax returns in federal and various state and local jurisdictions. With few exceptions, we are no longer subject to federal, state and

local, or non-U.S. income tax examinations for years before 2001. The federal tax return for 2008 is under concurrent year processing (accelerated

audits), which is expected to be completed in 2011. We also currently have an open audit in France for the years 2001 through 2004, related to our

Façonnable business which we sold in 2007. Unrecognized tax benefits related to federal, state and foreign tax positions may decrease by $15 by

January 28, 2012, subject to the completion of examinations and the expiration of various statutes of limitations.

January 29, 2011 January 30, 2010

Compensation and benefits accruals $146 $123

Accrued expenses 75 67

Merchandise inventories 25 24

Land, buildings and equipment basis and

depreciation differences – 13

Gift cards and gift certificates 18 18

Loyalty reward certificates 17 12

Allowance for credit losses 56 74

Federal benefit of state taxes 9 11

Other 14 11

Total deferred tax assets 360 353

Land, buildings and equipment basis and

depreciation differences (4) –

Total deferred tax liabilities (4) –

Net deferred tax assets $356 $353

Fiscal year 2010 2009 2008

Unrecognized tax benefit at beginning of year $43 $28 $27

Gross increase to tax positions in prior periods 3 18 2

Gross decrease to tax positions in prior periods (3) (3) (1)

Gross increase to tax positions in current period 3 3 4

Lapse of statute – – (1)

Settlements (3) (3) (3)

Unrecognized tax benefit at end of year $43 $43 $28