Nordstrom 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

LIQUIDITY AND CAPITAL RESOURCES

We maintain a level of liquidity sufficient to allow us to cover our seasonal cash needs and to maintain appropriate levels of short-term borrowings. We

believe that our operating cash flows and available credit facilities are sufficient to finance our cash requirements for the next 12 months and beyond.

Over the long term, we manage our cash and capital structure to maximize shareholder return, maintain our solid financial position and allow flexibility

for strategic initiatives. We regularly assess our debt and leverage levels, capital expenditure requirements, debt service payments, dividend payouts,

potential share repurchases and other future investments. We believe our existing cash on-hand, operating cash flows, available credit facilities and

potential future borrowings will be sufficient to fund these scheduled future payments and potential long-term initiatives.

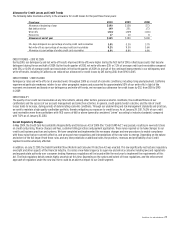

Operating Activities

Net cash provided by operating activities was $1,177 in 2010 and $1,251 in 2009. The majority of our operating cash inflows are derived from sales. We

also receive cash payments for property incentives from developers. Our operating cash outflows generally consist of payments to our merchandise

vendors (net of vendor allowances), payments to our employees for wages, salaries and other employee benefits and payments to our landlords for

rent. Operating cash outflows also include payments for income taxes and interest payments on our short- and long-term borrowings.

The decrease in cash provided by operating activities in 2010 compared with 2009 was due primarily to working capital initiatives undertaken in 2009,

which resulted in increased cash generated from operating activities in that year. Additionally, in 2010, we made higher payments for performance-

related incentives and income taxes compared with 2009, relating to the improved earnings performance we experienced in 2009 as compared

with 2008.

In 2011, we expect our operating cash flows to increase as a result of higher sales and earnings.

Investing Activities

Net cash used in investing activities was $462 in 2010 and $541 in 2009. Our investing cash flows primarily consist of capital expenditures and changes in

credit card receivables associated with cardholder purchases outside of Nordstrom using our Nordstrom VISA credit cards.

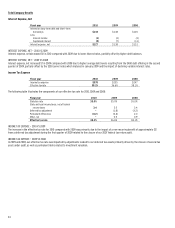

CAPITAL EXPENDITURES

Our capital expenditures over the last three years totaled $1,322, with $399 in 2010, $360 in 2009 and $563 in 2008. Capital expenditures included

investments in new stores and relocations, remodels and information technology improvements.

Capital expenditures increased in 2010 compared with 2009 due to greater store remodel activity and the timing of expenditures incurred for new

stores. The following table summarizes our store count and square footage activity for the past three fiscal years:

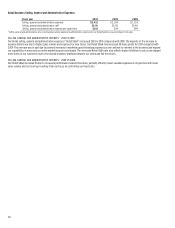

Store count Square footage

Fiscal year 2010 2009 2008 2010 2009 2008

Total, beginning of period 184 169 156

22.8 21.9 20.5

Store openings:

Nordstrom full-line stores 3 3 8

0.4 0.5 1.2

Nordstrom Rack and other stores 17 13 6

0.6 0.4 0.2

Closed stores - (1) (1)

- - -

Total, end of period 204 184 169

23.8 22.8 21.9

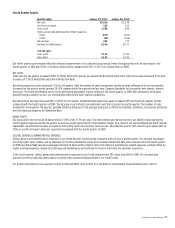

Additionally, we relocated one Nordstrom full-line store and one Nordstrom Rack store in 2010, compared with one Nordstrom full-line store in 2009.

Our 2010 store openings and relocations increased our gross square footage by 4.7%.

To date in 2011, we have opened three Nordstrom Rack stores. During the remainder of 2011, we anticipate opening three Nordstrom full-line stores and

fourteen additional Nordstrom Rack stores, as well as relocating two Nordstrom Rack stores. This will increase our gross square footage by

approximately 4.3%.