Nordstrom 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

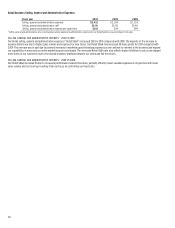

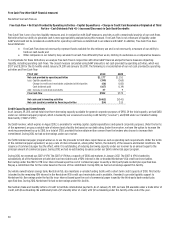

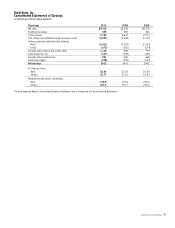

Free Cash Flow (Non-GAAP financial measure)

We define Free Cash Flow as:

Free Cash Flow = Net Cash Provided By Operating Activities – Capital Expenditures – Change in Credit Card Receivables Originated at Third

Parties – Cash Dividends Paid +/(–) Increase/(Decrease) in Cash Book Overdrafts

Free Cash Flow is one of our key liquidity measures, and, in conjunction with GAAP measures, provides us with a meaningful analysis of our cash flows.

We believe that our ability to generate cash is more appropriately analyzed using this measure. Free Cash Flow is not a measure of liquidity under

GAAP and should not be considered a substitute for operating cash flows as determined in accordance with GAAP. In addition, Free Cash Flow does

have limitations:

Free Cash Flow does not necessarily represent funds available for discretionary use and is not necessarily a measure of our ability to

fund our cash needs; and

Other companies in our industry may calculate Free Cash Flow differently than we do, limiting its usefulness as a comparative measure.

To compensate for these limitations, we analyze Free Cash Flow in conjunction with other GAAP financial and performance measures impacting

liquidity, including operating cash flows. The closest measure calculated using GAAP amounts is net cash provided by operating activities, which was

$1,177 and $1,251 for the 12 months ended January 29, 2011 and January 30, 2010. The following is a reconciliation of our net cash provided by operating

activities and Free Cash Flow:

Fiscal year 2010 2009

Net cash provided by operating activities $1,177 $1,251

Less: Capital expenditures (399) (360)

Change in credit card receivables originated at third parties (66) (182)

Cash dividends paid (167) (139)

Add: Increase in cash book overdrafts 37 9

Free Cash Flow $582 $579

Net cash used in investing activities $(462) $(541)

Net cash (used in) provided by financing activities $(4) $13

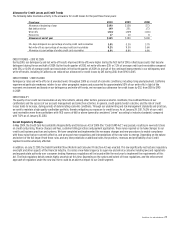

Credit Capacity and Commitments

As of January 29, 2011, we had total short-term borrowing capacity available for general corporate purposes of $950. Of the total capacity, we had $650

under our commercial paper program, which is backed by our unsecured revolving credit facility (“revolver”), and $300 under our Variable Funding

Note facility (“2007-A VFN”).

Our $650 revolver, which expires in August 2012, is available for working capital, capital expenditures and general corporate purposes. Under the terms

of the agreement, we pay a variable rate of interest and a facility fee based on our debt rating. Under the revolver, we have the option to increase the

revolving commitment by up to $100, to a total of $750, provided that we obtain written consent from the lenders who choose to increase their

commitment. During 2010, we had no borrowings under our revolver.

Our $650 commercial paper program allows us to use the proceeds to fund share repurchases as well as operating cash requirements. Under the terms

of the commercial paper agreement, we pay a rate of interest based on, among other factors, the maturity of the issuance and market conditions. The

issuance of commercial paper has the effect, while it is outstanding, of reducing borrowing capacity under our revolver by an amount equal to the

principal amount of commercial paper. During 2010, we had no outstanding issuances under our $650 commercial paper program.

During 2010, we renewed our 2007-A VFN. The 2007-A VFN has a capacity of $300 and matures in January 2012. The 2007-A VFN is backed by

substantially all of the Nordstrom private label card receivables and a 90% interest in the co-branded Nordstrom VISA credit card receivables.

Borrowings under the 2007-A VFN incur interest based upon the cost of commercial paper issued by a third-party bank conduit plus specified fees.

We pay a commitment fee for the notes based on the size of the commitment. During 2010, we had no borrowings against this facility.

Our wholly owned federal savings bank, Nordstrom fsb, also maintains a variable funding facility with a short-term credit capacity of $100. This facility

is backed by the remaining 10% interest in the Nordstrom VISA credit card receivables and is available, if needed, to provide liquidity support to

Nordstrom fsb. Borrowings under the facility incur interest based upon the cost of commercial paper issued by the third-party bank conduit plus

specified fees. During 2010, Nordstrom fsb had no borrowings under this facility.

We maintain trade and standby letters of credit to facilitate international payments. As of January 29, 2011, we have $10 available under a trade letter of

credit, with $6 outstanding. We additionally hold a $15 standby letter of credit, with $12 outstanding under this facility at the end of the year.