Nordstrom 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

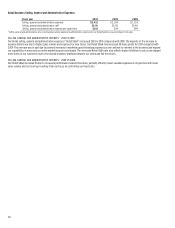

24

Total Company Results

Interest Expense, Net

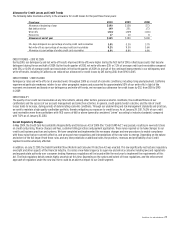

Fiscal year 2010 2009 2008

Interest on long-term debt and short-term

borrowings $133 $148 $145

Less:

Interest income (1) (3) (3)

Capitalized interest (5) (7) (11)

Interest expense, net $127 $138 $131

INTEREST EXPENSE, NET — 2010 VS 2009

Interest expense, net decreased $11 in 2010 compared with 2009 due to lower interest rates, partially offset by higher debt balances.

INTEREST EXPENSE, NET — 2009 VS 2008

Interest expense, net increased $7 in 2009 compared with 2008 due to higher average debt levels resulting from the $400 debt offering in the second

quarter of 2009, partially offset by the $250 senior notes which matured in January 2009 and the impact of declining variable interest rates.

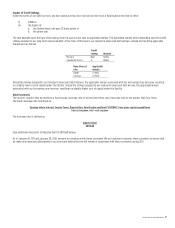

Income Tax Expense

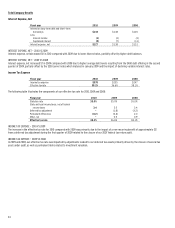

Fiscal year 2010 2009 2008

Income tax expense $378 $255 $247

Effective tax rate 38.2% 36.6% 38.1%

The following table illustrates the components of our effective tax rate for 2010, 2009 and 2008:

Fiscal year 2010 2009 2008

Statutory rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal

income taxes 3.4 3.5 3.4

Deferred tax adjustment – (1.8) (3.2)

Permanent differences (0.2) (0.6) 2.0

Other, net – 0.5 0.9

Effective tax rate 38.2% 36.6% 38.1%

INCOME TAX EXPENSE — 2010 VS 2009

The increase in the effective tax rate for 2010 compared with 2009 was primarily due to the impact of a non-recurring benefit of approximately $12

from a deferred tax adjustment during the first quarter of 2009 related to the closure of our 2007 federal tax return audit.

INCOME TAX EXPENSE — 2009 VS 2008

In 2009 and 2008, our effective tax rate was impacted by adjustments related to our deferred tax assets primarily driven by the closure of several tax

years under audit, as well as permanent items related to investment valuation.