Neiman Marcus 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476 -

477

477 -

478

478 -

479

479 -

480

480 -

481

481 -

482

482 -

483

483 -

484

484 -

485

485 -

486

486 -

487

487 -

488

488 -

489

489 -

490

490 -

491

491 -

492

492 -

493

493 -

494

494 -

495

495 -

496

496 -

497

497 -

498

498 -

499

499 -

500

500 -

501

501 -

502

502 -

503

503 -

504

504 -

505

505 -

506

506 -

507

507 -

508

508 -

509

509

|

|

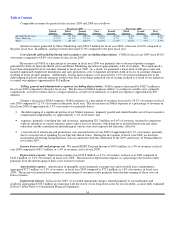

Table of Contents

Other expenses of $21.9 million in fiscal year 2010 and $22.5 million in fiscal year 2009 consist primarily of costs

(professional fees and severance) incurred in connection with cost reductions and corporate initiatives.

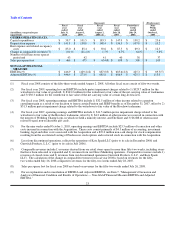

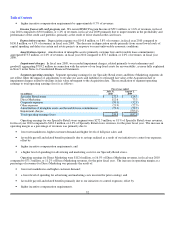

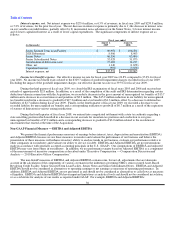

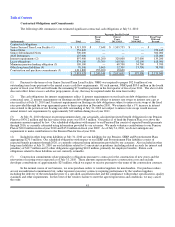

Interest expense, net. Net interest expense was $237.1 million, or 6.4% of revenues, in fiscal year 2010 and $235.6 million,

or 6.5% of revenues, for the prior fiscal year. The significant components of interest expense are as follows:

Fiscal year ended

(in thousands)

July 31,

2010

August 1,

2009

Senior Secured Term Loan Facility $ 83,468 $ 90,952

2028 Debentures 8,886 8,906

Senior Notes 68,315 66,356

Senior Subordinated Notes 51,732 52,028

Amortization of debt issue costs 18,697 17,185

Other, net 6,296 1,140

Capitalized interest (286)(993)

Interest expense, net $ 237,108 $ 235,574

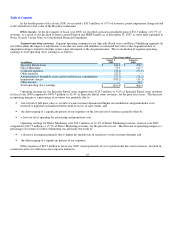

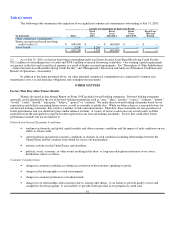

Income tax (benefit) expense. In fiscal year 2010, we generated a loss before income taxes of approximately $5.3 million,

which resulted in a recorded income tax benefit of approximately $3.5 million and an effective tax rate of 65.4%. The effective tax

rate exceeds the statutory rate primarily due to the relative significance of state taxes, non-taxable income and non-deductible expense

to our pretax loss. For fiscal year 2009, we generated a loss before income taxes of approximately $888.5 million, which resulted in a

recorded income tax benefit of approximately $220.5 million and an effective tax rate of 24.8%. For fiscal year 2009, no income tax

benefit exists related to the $329.7 million of goodwill impairment charges recorded. Excluding the impact of the goodwill

impairment charges, our effective income tax rate was 39.5% for fiscal year 2009.

During the fourth quarter of fiscal year 2010, the Internal Revenue Service (IRS) closed their examination of our fiscal year

2007 federal income tax return with no changes or assessments. We anticipate the IRS will begin an examination of fiscal years 2008

and 2009 sometime in fiscal year 2011. With respect to state and local jurisdictions, with limited exceptions, the Company and its

subsidiaries are no longer subject to income tax audits for fiscal years before 2006. We believe our recorded tax liabilities as of

July 31, 2010 are sufficient to cover any potential assessments to be made by the IRS or other taxing authorities upon the completion

of their examinations and we will continue to review our recorded tax liabilities for potential audit assessments based upon subsequent

events, new information and future circumstances. We believe it is reasonably possible that additional adjustments in the amounts of

our unrecognized tax benefits could occur within the next twelve months as a result of settlements with tax authorities or expiration of

statutes of limitation. At this time, we do not believe such adjustments will have a material impact on our consolidated financial

statements.

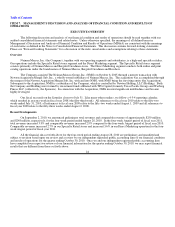

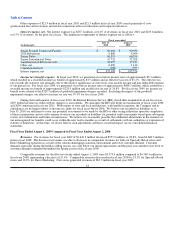

Fiscal Year Ended August 1, 2009 Compared to Fiscal Year Ended August 2, 2008

Revenues. Our revenues for fiscal year 2009 of $3,643.3 million decreased $957.2 million, or 20.8%, from $4,600.5 million

in fiscal year 2008. The decrease in revenues was due to decreases in comparable revenues for both our Specialty Retail stores and

Direct Marketing operation as a result of the current challenging economic environment and lower customer demand. Customer

demand, especially during the holiday selling season, was well below our initial expectations and the prior year and the lower level of

customer demand continued throughout the Spring season of fiscal year 2009.

Comparable revenues for the fifty-two weeks ended August 1, 2009 were $3,575.4 million compared to $4,548.5 million in

fiscal year 2008, representing a decrease of 21.4%. Comparable revenues decreased in fiscal year 2009 by 23.2% for Specialty Retail

stores and 12.2% for Direct Marketing. New stores generated revenues of $67.9 million in fiscal year 2009.

33