Neiman Marcus 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

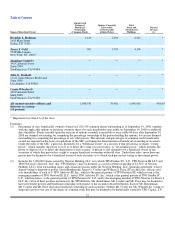

Management Stockholders' Agreement

Subject to the Management Stockholders' Agreement, certain members of management, including Burton M. Tansky, Karen

W. Katz, James E. Skinner, Brendan L. Hoffman, and James J. Gold, along with 22 other members of management, elected to invest

in the Company by contributing cash or equity interests in NMG, or a combination of both, to the Company prior to the merger and

receiving equity interests in the Company in exchange therefor immediately after completion of the merger pursuant to rollover

agreements with NMG and the Company entered into prior to the effectiveness of the merger. The aggregate amount of this

investment was approximately $25.6 million. The Management Stockholders' Agreement creates certain rights and restrictions on

these equity interests, including transfer restrictions and tag-along, drag-along, put, call, and registration rights in certain

circumstances.

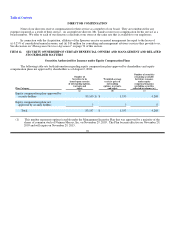

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

The Audit Committee has adopted policies and procedures for pre-approving all audit and permissible non-audit services

performed by our independent registered public accounting firm. Under these policies, the Audit Committee pre-approves the use of

audit and audit-related services following approval of the independent registered public accounting firm's audit plan. All services

detailed in the audit plan are considered pre-approved. If, during the course of the audit, the independent registered public accounting

firm expects fees to exceed the approved fee estimate between 10 percent and 15 percent, those fees must be pre-approved in advance

by the Audit Committee Chairman. If fees are expected to exceed the approved estimate by more than 15 percent, those fees must be

approved in advance by the Audit Committee.

Other non-audit services of less than $50,000 that are not restricted services may be pre-approved by both the chief financial

officer and the controller, provided those services will not impair the independence of the independent auditor. These services will be

considered approved by the Audit Committee, provided those projects are discussed with the Audit Committee at its next scheduled

meeting. Services between $50,000 and $100,000 in estimated fees must be pre-approved by the Chairman of the Audit Committee,

acting on behalf of the entire Audit Committee. Services of greater than $100,000 in estimated fees must be pre-approved by the Audit

Committee. All fee overruns will be discussed with the Audit Committee at the next scheduled meeting.

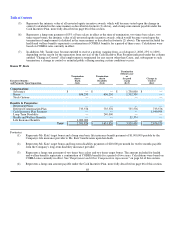

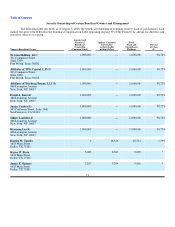

Principal Accounting Fees and Services

On March 19, 2007, we dismissed Deloitte & Touche LLP as our independent registered public accounting firm and

appointed Ernst & Young LLP in its place. In the discussion that follows, figures related to fiscal year 2007 reflect the combined

billings of both firms.

Audit Fees. The aggregate fees billed for the audits of the Company's annual financial statements for the fiscal years ended

August 2, 2008 and July 28, 2007 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q

were $1,535,000 and $1,718,000, respectively.

Audit-Related Fees. The aggregate fees billed for audit-related services for the fiscal years ended August 2, 2008 and

July 28, 2007 were $96,000 and $160,000, respectively. These fees related to accounting research and consultation and attestation

services for certain subsidiary companies for the fiscal years ended August 2, 2008 and July 28, 2007.

Tax Fees. The aggregate fees billed for tax services for the fiscal years ended August 2, 2008 and July 28, 2007 were

$192,000 and $344,000, respectively. These fees are related to tax compliance and planning.

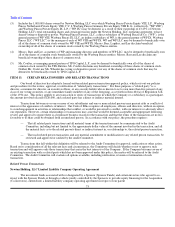

The Audit Committee has considered and concluded that the provision of permissible non-audit services is compatible with

maintaining our independent registered public accounting firm's independence.

75