Neiman Marcus 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

restructuring costs associated with an acquired business and recognize post-acquisition changes in tax uncertainties associated with a

business combination as a component of tax expense. SFAS 141(R) is to be applied prospectively to business combinations for which

the acquisition date is on or after December 15, 2008, or our fiscal year ending July 31, 2010. Generally, the effect of SFAS

141(R) will depend on future acquisitions. However, the accounting for the resolution of any tax uncertainties remaining as of

August 1, 2009 related to the Acquisition will be subject to the provisions of SFAS 141(R). We have not yet evaluated the impact, if

any, of adopting SFAS 141(R) on our consolidated financial statements.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, "Disclosures about Derivative

Instruments and Hedging Activities" (SFAS 161). SFAS 161 enhances current disclosures related to derivative instruments and

hedging activities to provide adequate information about how derivative and hedging activities affect an entity's financial position,

financial performance and cash flows. SFAS 161 is effective for financial statements issued for fiscal years and interim periods

beginning after November 15, 2008, or our second fiscal quarter ending January 31, 2009. We have not yet evaluated the impact, if

any, of adopting SFAS 161 on our consolidated financial statements.

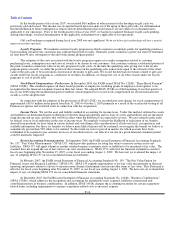

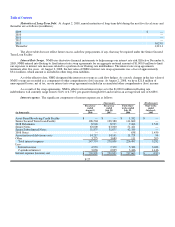

NOTE 2. PURCHASE ACCOUNTING

We accounted for the Acquisition in accordance with the provisions of Statement of Financial Accounting Standards

No. 141 "Business Combinations" (SFAS 141), whereby the purchase price paid to effect the Acquisition was allocated to state the

acquired assets and liabilities at fair value. The Acquisition and the allocation of the purchase price were recorded as of October 1,

2005, the beginning of our October accounting period.

In connection with the purchase price allocation, we made estimates of the fair values of our long-lived and intangible assets

based upon assumptions related to future cash flows, discount rates and asset lives and we recorded adjustments to increase the

carrying values of our property and equipment and inventory, to establish intangible assets for our tradenames, customer lists and

favorable lease commitments and to revalue our long-term benefit plan obligations, among other things. The final purchase accounting

adjustments, as reflected in our July 29, 2006 consolidated balance sheet, were as follows (in millions):

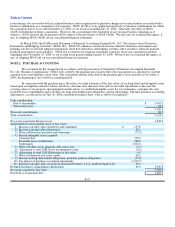

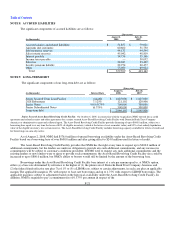

Cash consideration:

Paid to shareholders $ 5,092.9

Transaction costs 63.5

5,156.4

Non-cash consideration 36.7

Total consideration 5,193.1

Net assets acquired at historical cost 1,638.2

Adjustments to state acquired assets at fair value:

1) Increase carrying value of property and equipment $ 137.8

2) Increase carrying value of inventory 38.1

3) Write-off historical goodwill and tradenames (71.5)

4) Record intangible assets acquired

Customer lists 576.5

Favorable lease commitments 480.0

Tradenames 1,621.8

5) Write-off other assets, primarily debt issue costs (3.7)

6) Adjustment to state 2008 Notes at redemption value (6.2)

7) Adjustment to state 2028 Debentures at fair value 4.5

8) Write-off deferred real estate credits 90.2

9) Increase in long-term benefit obligations, primarily pension obligations (57.6)

10) Tax impact of purchase accounting adjustments (1,019.7)

11) Increase carrying values of assets of Gurwitch Products, L.L.C and Kate Spade LLC. 90.4

Deemed dividend to management shareholders 69.2 1,949.8

Net assets acquired at fair value 3,588.0

Goodwill at Acquisition date $ 1,605.1

F-17