Neiman Marcus 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

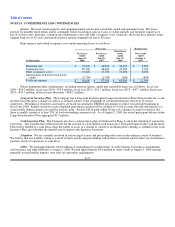

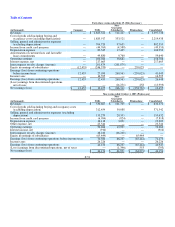

Table of Contents

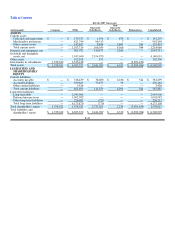

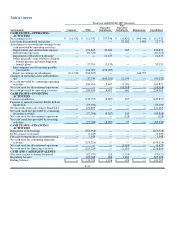

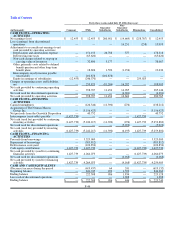

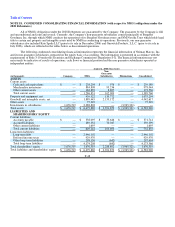

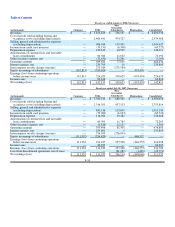

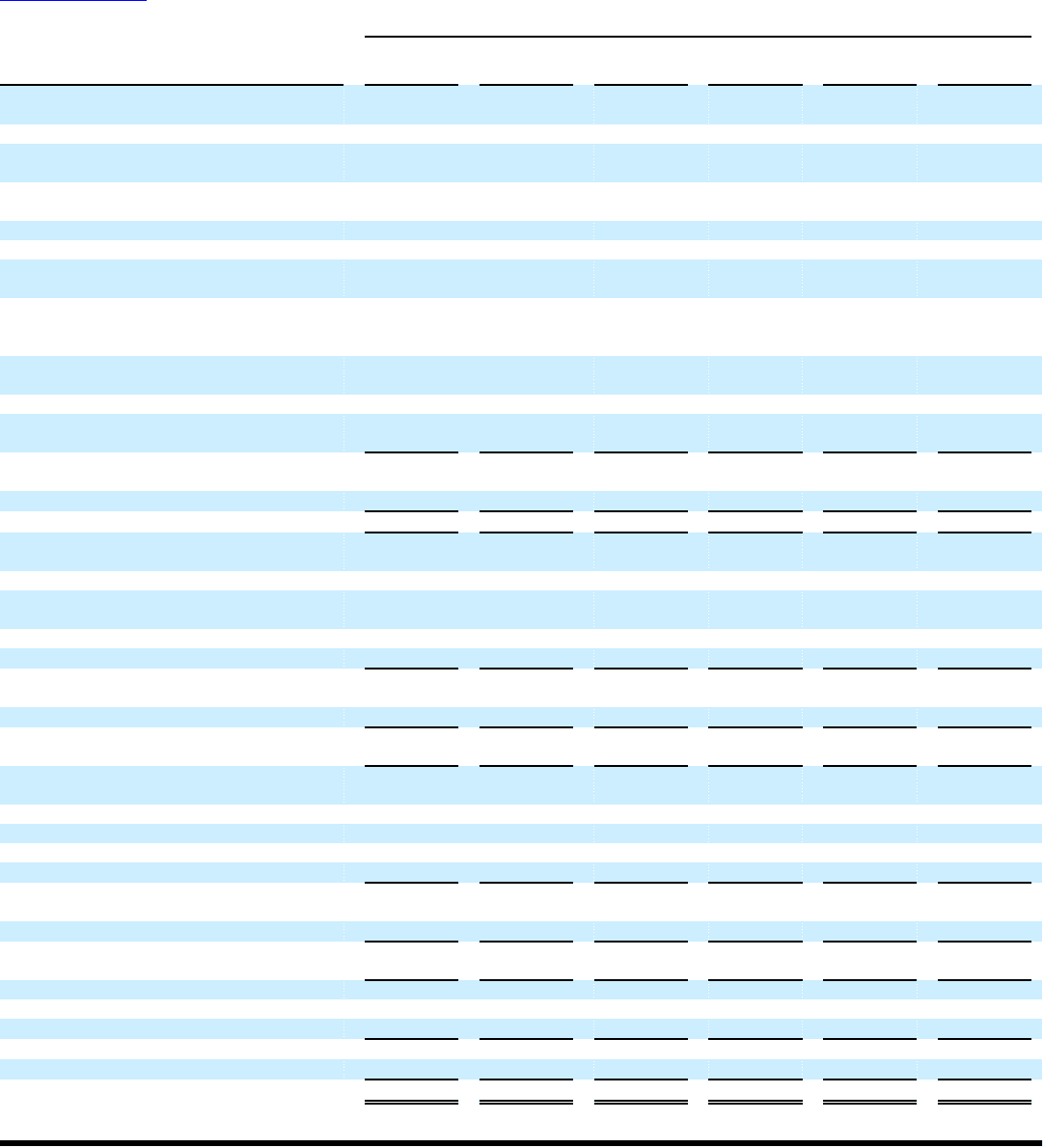

Forty-three weeks ended July 29, 2006 (Successor)

(in thousands) Company NMG

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

CASH FLOWS—OPERATING

ACTIVITIES

Net earnings (loss) $ 12,455 $ 12,455 $ 260,981 $ (14,669) $ (258,767) $ 12,455

Loss (earnings) from discontinued

operations — — — 14,251 (258) 13,993

Adjustments to reconcile net earnings to net

cash provided by operating activities:

Depreciation and amortization expense — 151,153 26,788 377 — 178,318

Deferred income taxes — (65,620) — — — (65,620)

Non-cash charges related to step-up in

carrying value of inventory — 32,890 5,177 — — 38,067

Other, primarily costs related to defined

benefit pension and other long-term

benefit plans — 18,696 1,590 (1,256) — 19,030

Intercompany royalty income payable

(receivable) — 201,878 (201,878) — — —

Equity in earnings of subsidiaries (12,455) (246,570) — — 259,025 —

Changes in operating assets and liabilities,

net — 253,825 (81,204)16,282 — 188,903

Net cash provided by continuing operating

activities — 358,707 11,454 14,985 — 385,146

Net cash used for discontinued operations — — — (4,381)— (4,381)

Net cash provided by operating activities — 358,707 11,454 10,604 — 380,765

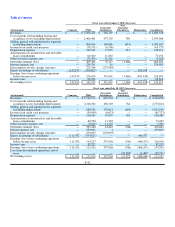

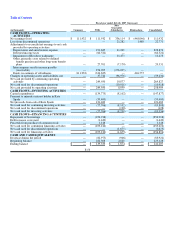

CASH FLOWS—INVESTING

ACTIVITIES

Capital expenditures — (126,546) (11,390) (276) — (138,212)

Acquisition of The Neiman Marcus

Group, Inc. — (5,156,423) — — — (5,156,423)

Net proceeds from the Gurwitch Disposition — 40,752 — — — 40,752

Intercompany (receivable) payable (1,427,739)— — — 1,427,739 —

Net cash (used for) provided by continuing

investing activities (1,427,739) (5,242,217) (11,390) (276) 1,427,739 (5,253,883)

Net cash used for discontinued operations — — — (5,919)— (5,919)

Net cash (used for) provided by investing

activities (1,427,739)(5,242,217)(11,390)(6,195)1,427,739 (5,259,802)

CASH FLOWS—FINANCING

ACTIVITIES

Proceeds from borrowings — 3,325,000 — — — 3,325,000

Repayment of borrowings — (385,812) — — — (385,812)

Debt issuance costs paid — (102,854) — — — (102,854)

Cash equity contributions 1,427,739 1,427,739 — — (1,427,739)1,427,739

Net cash provided by (used for) continuing

financing activities 1,427,739 4,264,073 — — (1,427,739) 4,264,073

Net cash used for discontinued operations — — — (4,168)— (4,168)

Net cash provided by (used for) financing

activities 1,427,739 4,264,073 — (4,168)(1,427,739)4,259,905

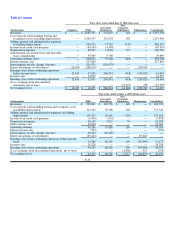

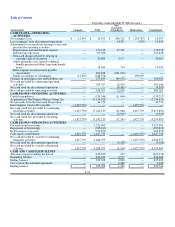

CASH AND CASH EQUIVALENTS

(Decrease) increase during the period — (619,437) 64 241 — (619,132)

Beginning balance — 841,745 922 1,593 — 844,260

Ending balance — 222,308 986 1,834 — 225,128

Less cash of discontinued operations — — — 1,388 — 1,388

Ending balance $ — $ 222,308 $ 986 $ 446 $ — $ 223,740

F-46