Neiman Marcus 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

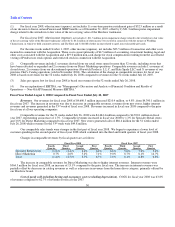

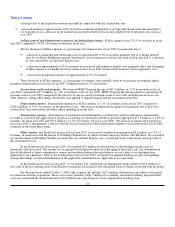

• a $26.7 million decrease in pretax cash interest requirements on indebtedness incurred in connection with the Acquisition;

• a $9.8 million decrease in cash requirements for income taxes; offset by

• a $15.0 million voluntary contribution to our defined benefit pension plan.

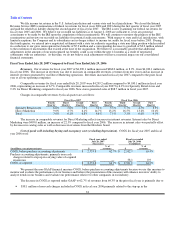

Net cash used for investing activities, representing capital expenditures, was $183.5 million in fiscal year 2008. Net cash

used for investing activities was $85.9 million in fiscal year 2007 which consisted of:

• capital expenditures of $147.9 million; and

• the purchase of the minority interest held in Kate Spade for $59.4 million; partially offset by

• $121.5 million received from Liz Claiborne, Inc. for the sale of Kate Spade.

We incurred significant capital expenditures in fiscal 2008 related to the construction of new stores in Natick and Topanga

(the greater Los Angeles area) and the remodel of our Atlanta and Westchester stores. We incurred significant capital expenditures in

fiscal 2007 related to the construction of new stores in Charlotte, Austin and Natick and the remodel of our Atlanta store. We opened

our Charlotte store in September 2006, our Austin store in March 2007 and our Natick store in September 2007. We opened our

Topanga store in September 2008. We currently project capital expenditures for fiscal year 2009 to be approximately $155 to $165

million.

Net cash used for financing activities was $3.9 million in fiscal year 2008 as compared to $256.9 million in fiscal year 2007.

In fiscal year 2007, we voluntarily repaid $250.0 million principal amount of the loans under the Senior Secured Term Loan Facility.

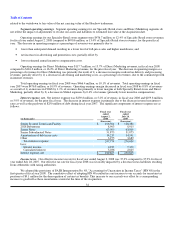

Financing Structure at August 2, 2008

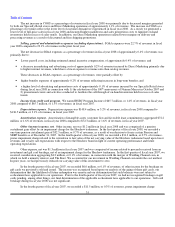

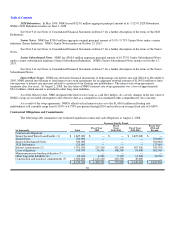

Our major sources of funds are comprised of vendor financing, a $600.0 million Asset-Based Revolving Credit Facility,

$1,625.0 million Senior Secured Term Loan Facility, $700.0 million Senior Notes, $500.0 million Senior Subordinated Notes,

$125.0 million 2028 Debentures and operating leases.

Senior Secured Asset-Based Revolving Credit Facility. NMG's senior secured Asset-Based Revolving Credit Facility

provides financing of up to $600.0 million, subject to a borrowing base equal to at any time the lesser of 80% of eligible inventory

(valued at the lower of cost or market value) and 85% of net orderly liquidation value of the eligible inventory, less certain reserves.

As of August 2, 2008, NMG had $576.0 million of unused borrowing availability under the Asset-Based Revolving Credit

Facility based on a borrowing base of over $600.0 million and after giving effect to $24.0 million used for letters of credit.

See Note 9 of our Notes to Consolidated Financial Statements in Item 15 for a further description of the terms of the Asset-

Based Revolving Credit Facility.

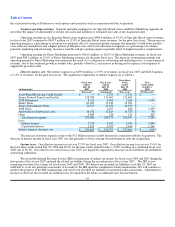

Senior Secured Term Loan Facility. In October 2005, NMG entered into a credit agreement and related security and other

agreements for a $1,975.0 million Senior Secured Term Loan Facility. NMG voluntarily repaid $100.0 million principal amount of its

loans under the Senior Secured Term Loan Facility in fiscal year 2006 and $250 million in fiscal year 2007.

At August 2, 2008, borrowings under the Senior Secured Term Loan Facility bore interest at a rate per annum equal to, at

NMG's option, either (a) a base rate determined by reference to the higher of (1) the prime rate of Credit Suisse and (2) the federal

funds effective rate plus 1/2 of 1% or (b) a LIBOR rate, subject to certain adjustments, in each case plus an applicable margin. At

August 2, 2008, the applicable margin with respect to base rate borrowings was 0.75% and the applicable margin with respect to

LIBOR borrowings was 1.75%. The interest rate on the outstanding borrowings pursuant to the Senior Secured Term Loan Facility

was 4.42% at August 2, 2008.

See Note 9 of our Notes to Consolidated Financial Statements in Item 15 for a further description of the terms of the Senior

Secured Term Loan Facility.

38