Neiman Marcus 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

2028 Debentures. In May 1998, NMG issued $125.0 million aggregate principal amount of its 7.125% 2028 Debentures.

NMG's 2028 Debentures mature on June 1, 2028.

See Note 9 of our Notes to Consolidated Financial Statements in Item 15 for a further description of the terms of the 2028

Debentures.

Senior Notes. NMG has $700.0 million aggregate original principal amount of 9.0% / 9.75% Senior Notes under a senior

indenture (Senior Indenture). NMG's Senior Notes mature on October 15, 2015.

See Note 9 of our Notes to Consolidated Financial Statements in Item 15 for a further description of the terms of the Senior

Notes.

Senior Subordinated Notes. NMG has $500.0 million aggregate principal amount of 10.375% Senior Subordinated Notes

under a senior subordinated indenture (Senior Subordinated Indenture). NMG's Senior Subordinated Notes mature on October 15,

2015.

See Note 9 of our Notes to Consolidated Financial Statements in Item 15 for a further description of the terms of the Senior

Subordinated Notes.

Interest Rate Swaps. NMG uses derivative financial instruments to help manage our interest rate risk. Effective December 6,

2005, NMG entered into floating to fixed interest rate swap agreements for an aggregate notional amount of $1,000.0 million to limit

our exposure to interest rate increases related to a portion of our floating rate indebtedness. The interest rate swap agreements

terminate after five years. At August 2, 2008, the fair value of NMG's interest rate swap agreements was a loss of approximately

$34.4 million, which amount is included in other long-term liabilities.

As of the effective date, NMG designated the interest rate swaps as cash flow hedges. As a result, changes in the fair value of

NMG's swaps are recorded subsequent to the effective date as a component of accumulated other comprehensive (loss) income.

As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in floating rate

indebtedness will currently range from 6.524% to 6.733% per quarter through 2010 and result in an average fixed rate of 6.608%.

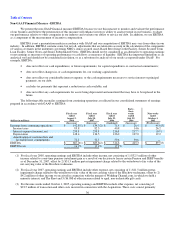

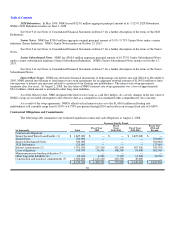

Contractual Obligations and Commitments

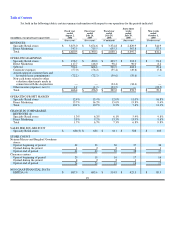

The following table summarizes our estimated significant contractual cash obligations at August 2, 2008:

Payments Due By Period

(in thousands) Total

Fiscal Year

2009

Fiscal

Years

2010-2011

Fiscal Years

2012-2013

Fiscal Year

2014 and

Beyond

Contractual obligations:

Senior Secured Term Loan Facility (1) $ 1,625,000 $ — $ — $ 1,625,000 $ —

Senior Notes 700,000 — — — 700,000

Senior Subordinated Notes 500,000 — — — 500,000

2028 Debentures 125,000 — — — 125,000

Interest requirements (2) 1,391,300 217,100 421,200 367,300 385,700

Lease obligations 938,700 56,300 106,500 93,400 682,500

Minimum pension funding obligation (3) — — — — —

Other long-term liabilities (4) 62,100 4,200 9,700 11,500 36,700

Construction and purchase commitments (5) 1,380,600 1,113,100 218,500 49,000 —

$ 6,722,700 $ 1,390,700 $ 755,900 $ 2,146,200 $ 2,429,900

39