Neiman Marcus 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

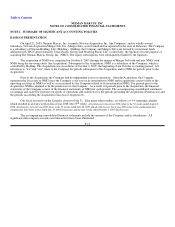

Leases. We lease certain retail stores and office facilities. Stores we own are often subject to ground leases. The terms of our

real estate leases, including renewal options, range from 2 to 101 years. Most leases provide for monthly fixed minimum rentals or

contingent rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes, insurance, common

area maintenance costs and other occupancy costs. For leases that contain predetermined, fixed calculations of the minimum rentals,

we recognize rent expense on a straight-line basis over the lease term. We recognize contingent rent expenses when it is probable that

the sales thresholds will be reached during the year.

We receive allowances from developers related to the construction of our stores. We record these allowances as deferred real

estate credits which we recognize as a reduction of rent expense on a straight-line basis over the lease term beginning with the date the

Company takes possession of the leased asset. We received construction allowances aggregating $36.8 million in fiscal year 2008, $24.6 million in

fiscal year 2007, $30.7 million for the forty-three weeks ended July 29, 2006 and $2.0 million for the nine weeks ended October 1, 2005.

Financial Instruments. We use derivative financial instruments to help manage our interest rate risk. Effective December 6,

2005, NMG entered into floating to fixed interest rate swap agreements for an aggregate notional amount of $1,000.0 million to limit

our exposure to interest rate increases related to a portion of our floating rate indebtedness. The interest rate swap agreements

terminate after five years. At August 2, 2008, the fair value of NMG's interest rate swap agreements was a loss of approximately

$34.4 million, which amount is included in other long-term liabilities.

As of the effective date, NMG designated the interest rate swaps as cash flow hedges. As a result, changes in the fair value of

NMG's swaps are recorded as a component of other comprehensive (loss) income. At August 2, 2008, we have $21.8 million of

unrecognized losses, net of tax, on our interest rate swap agreements included in accumulated other comprehensive (loss) income.

As a result of the swap agreements, NMG's effective fixed interest rates as to the $1,000.0 million in floating rate

indebtedness will currently range from 6.524% to 6.733% per quarter through 2010 and result in an average fixed rate of 6.608%.

Benefit Plans. We sponsor a noncontributory defined benefit pension plan (Pension Plan) and an unfunded supplemental

executive retirement plan (SERP Plan) which provides certain employees additional pension benefits. In calculating our obligations

and related expense, we make various assumptions and estimates, after consulting with outside actuaries and advisors. The annual

determination of expense involves calculating the estimated total benefits ultimately payable to plan participants and allocating this

cost to the periods in which services are expected to be rendered. We use the projected unit credit method in recognizing pension

liabilities. The Pension and SERP Plans are valued annually as of the end of each fiscal year.

Significant assumptions related to the calculation of our obligations include the discount rate used to calculate the present

value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by the Pension Plan and the

average rate of compensation increase by plan participants. We review these assumptions annually based upon currently available

information, including information provided by our actuaries.

Self-insurance and Other Employee Benefit Reserves. We use estimates in the determination of the required accruals for

general liability, workers' compensation and health insurance as well as short-term disability and postretirement health care benefits.

We base these estimates upon an examination of historical trends, industry claims experience and independent actuarial estimates.

Projected claims information may change in the future and may require us to revise these reserves. Although we do not expect that we

will ultimately pay claims significantly different from our estimates, self-insurance reserves could be affected if future claims

experience differ significantly from our historical trends and assumptions.

Other Long-term Liabilities. Other long-term liabilities consist primarily of certain employee benefit obligations,

postretirement health care benefit obligations and the liability for scheduled rent increases.

Revenues. Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise

sold. Revenues from our Specialty Retail stores are recognized at the later of the point of sale or the delivery of goods to the customer.

Revenues from our Direct Marketing operations are recognized when the merchandise is delivered to the customer. Revenues

associated with gift cards are recognized at the time of redemption by the customer. Revenues exclude sales taxes collected from our

customers.

We maintain reserves for anticipated sales returns primarily based on our historical trends related to returns by our retail and

direct marketing customers. Our reserves for anticipated sales returns aggregated $45.0 million at August 2, 2008 and

F-14