Neiman Marcus 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

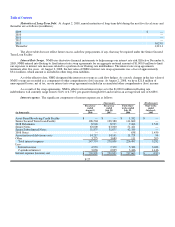

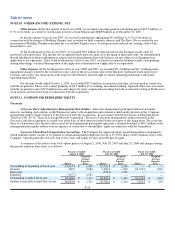

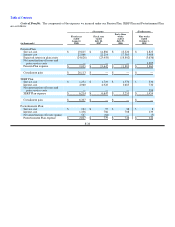

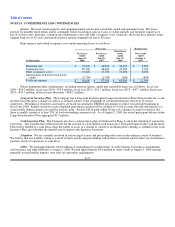

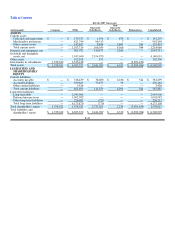

Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the

beginning of each fiscal year. With respect to the Pension Plan and the SERP Plan, our obligations consist of both a projected benefit

obligation (PBO) and an accumulated benefit obligation (ABO). The PBO represents the present value of benefits ultimately payable

to plan participants for both past and future services expected to be provided by the plan participants. The ABO represents the present

value of benefits payable to plan participants for only services rendered at the valuation date. Our obligations pursuant to our Pension

Plan, SERP Plan and Postretirement Plan are as follows:

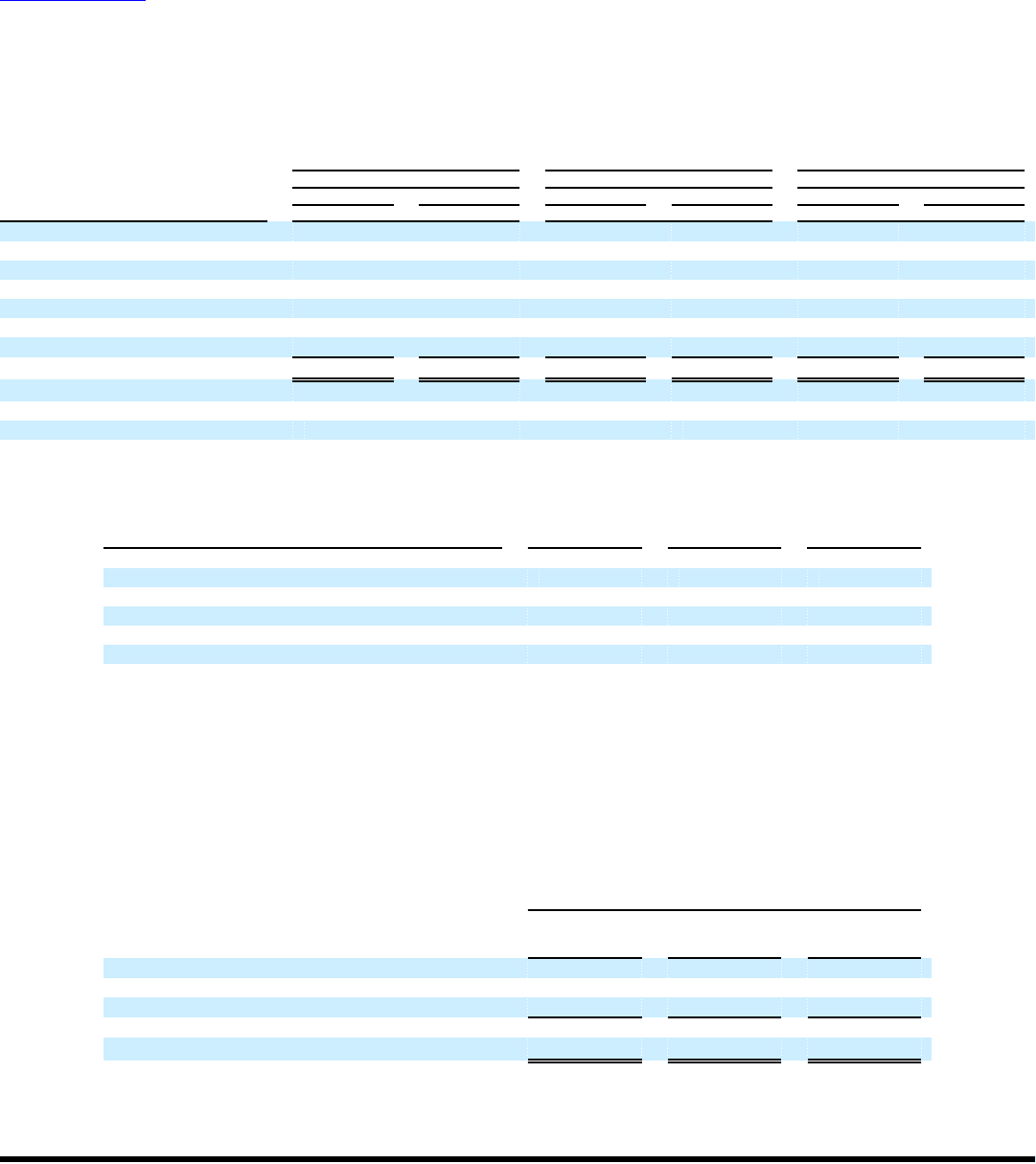

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

2008 2007 2008 2007 2008 2007

(in thousands) (Successor) (Successor) (Successor)

Projected benefit obligations:

Beginning of year $ 380,235 $ 364,720 $ 86,146 $ 78,322 $ 22,091 $ 12,975

Service cost 10,815 14,886 1,254 1,719 124 57

Interest cost 22,866 22,214 4,960 4,928 1,356 786

Actuarial (gain) loss (22,825) (9,695) (5,409) 3,076 (2,167) 9,104

Curtailment (26,113) — (7,091) — — —

Benefits paid, net (10,749)(11,890)(2,294)(1,899)(1,068)(831)

End of year $ 354,229 $ 380,235 $ 77,566 $ 86,146 $ 20,336 $ 22,091

Accumulated benefit obligations:

Beginning of year $ 337,047 $ 308,255 $ 68,105 $ 66,890

End of year $ 336,016 $ 337,047 $ 68,253 $ 68,105

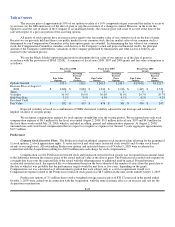

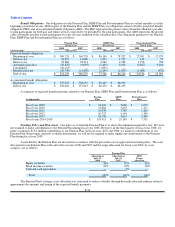

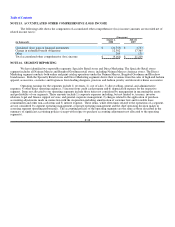

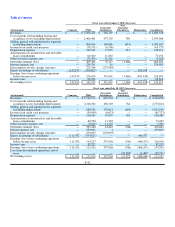

A summary of expected benefit payments related to our Pension Plan, SERP Plan and Postretirement Plan is as follows:

(in thousands)

Pension

Plan

SERP

Plan

Postretirement

Plan

Fiscal year 2009 $ 12,301 $ 3,086 $ 1,079

Fiscal year 2010 13,684 3,452 1,171

Fiscal year 2011 15,078 3,789 1,260

Fiscal year 2012 16,723 4,144 1,340

Fiscal year 2013 18,526 4,615 1,409

Fiscal years 2014-2018 $ 119,411 $ 29,189 $ 7,551

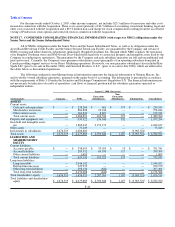

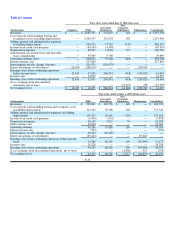

Funding Policy and Plan Assets. Our policy is to fund the Pension Plan at or above the minimum required by law. We were

not required to make contributions to the Pension Plan during fiscal year 2008. However, in the third quarter of fiscal year 2008, we

made a voluntary $15.0 million contribution to our Pension Plan. In fiscal years 2007 and 2006, we made no contributions to our

Pension Plan. Based upon currently available information, we will not be required to make significant contributions to the Pension

Plan during fiscal year 2009.

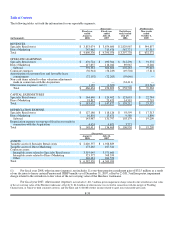

Assets held by the Pension Plan are invested in accordance with the provisions of our approved investment policy. The asset

allocation for our Pension Plan at the end of fiscal years 2008 and 2007 and the target allocation for fiscal year 2009, by asset

category, are as follows:

Pension Plan

Allocation at

July 31,

2008

Allocation at

July 31,

2007

2009

Target

Allocation

Equity securities 76% 76% 80%

Fixed income securities 24% 22% 20%

Cash and cash equivalents — 2%—

Total 100%100%100%

The Pension Plan's strategic asset allocation was structured to reduce volatility through diversification and enhance return to

approximate the amounts and timing of the expected benefit payments.

F-34