Neiman Marcus 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

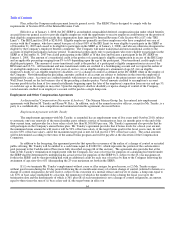

This agreement may be terminated by either party on three months' notice, subject to severance obligations in the event of

termination under certain circumstances (as described below).

If we terminate Ms. Katz's employment without cause or if she resigns for good reason or following her receipt of a notice of

non-renewal from the Company relating to the employment term, she will receive (i) an amount of annual incentive pay equal to a

prorated portion of her target bonus amount for the year in which the employment termination date occurs, and (ii) a lump sum equal

to two times the sum of her base salary and target bonus, at the level in effect as of the employment termination date; provided, however, that Ms. Katz

shall be required to repay this payment if she violates certain restrictive covenants in her agreement or if she is found to have engaged

in certain acts of wrongdoing, all as further described in the agreement. Ms. Katz is also entitled to continuation of certain benefits for

a two-year period following a termination of her employment for any reason as set forth more fully in her employment agreement.

If Ms. Katz's employment terminates before the end of the term due to her death or disability, we will pay her or her estate, as

applicable, (i) any unpaid salary through the date of termination and any bonus payable for the preceding fiscal year that has otherwise

not already been paid, (ii) any accrued but unused vacation days, (iii) any reimbursement for business travel and other expenses to

which she is entitled, and (iv) an amount of annual incentive pay equal to a prorated portion of her target bonus amount for the year in

which the employment termination date occurs.

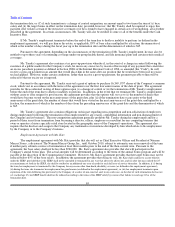

Ms. Katz's agreement also contains a tax gross-up provision whereby if, in the event of a change in control following the

existence of a public market for the Company's stock, she incurs any excise tax by reason of her receipt of any payment that

constitutes an excess parachute payment as defined in Section 280G of the Code, she will receive a gross-up payment in an amount

that would place her in the same after-tax position that she would have been in if no excise tax had applied. However, under certain

conditions, rather than receive a gross-up payment, the payments payable to her will be reduced so that no excise tax is imposed.

Ms. Katz's agreement also contains obligations on her part regarding non-competition and non-solicitation of employees

following the termination of her employment for any reason, confidential information and non-disparagement of the Company and its

business. The non-competition agreement generally prohibits Ms. Katz during employment and for a period of one year from

termination from becoming a director, officer, employee or consultant for any competing business that owns or operates a luxury

specialty retail store located in the geographic areas of the Company's operations. The agreement also requires that she disclose and

assign to the Company any trademarks or inventions developed by her which relate to her employment by the Company or to the

Company's business.

Confidentiality, Non-Competition and Termination Benefits Agreements

Each of the named executive officers and certain other officers, except for Mr. Tansky, are party to a confidentiality, non-

competition and termination benefits agreement that will provide for severance benefits if the employment of the affected individual is

terminated by the Company other than in the event of death, disability or termination for cause. These agreements provide for a

severance payment equal to one and one-half annual base salary payable over an eighteen month period, and reimbursement for

COBRA premiums for the same period. Each confidentiality, non-competition and termination benefits agreement contains restrictive covenants as a

condition to receipt of any payments payable thereunder.

Cash Incentive Plan

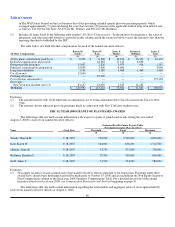

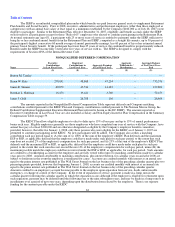

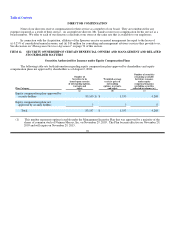

Following the consummation of the Acquisition, the Neiman Marcus, Inc. Cash Incentive Plan (referred to as the Cash

Incentive Plan) was adopted to aid in the retention of certain key executives, including the named executive officers. The Cash

Incentive Plan provides for the creation of a $14 million cash bonus pool to be shared by the participants based on the number of stock

options that were granted to each such participant pursuant to the Management Incentive Plan. Each participant in the Cash Incentive

Plan will be entitled to a cash bonus upon the earlier to occur of a change of control or an initial public offering, provided that the

internal rate of return to certain of our investors is positive. If the internal rate of return to certain of our investors is not positive, no amounts will be

paid under the Cash Incentive pool.

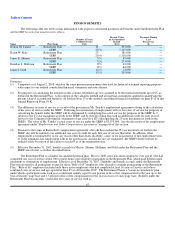

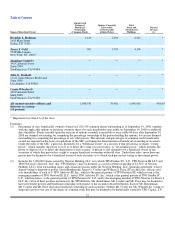

Based on the foregoing, each of the named executive officers would be entitled to receive the following percentages of the

remaining cash bonus pool on August 2, 2008, assuming there was a change in control or an initial public offering on that date, and

the rate of return to the Sponsors was positive:

66